Cash App Changes: A Comprehensive Overview

Cash App, a popular mobile payment service, has undergone several changes over the years. These changes have been aimed at improving the user experience, enhancing security, and expanding the range of services offered. In this article, we will delve into the various aspects of Cash App changes, providing you with a detailed and multi-dimensional introduction.

1. User Interface and Design

One of the most noticeable changes in Cash App is the evolution of its user interface and design. Initially, the app had a simple and straightforward layout, which made it easy for users to navigate. However, over time, the design has been refined to offer a more modern and visually appealing experience.

The latest version of Cash App features a sleek and clean interface, with a focus on simplicity and ease of use. The app now includes a new navigation bar at the bottom, making it easier to access different sections, such as the wallet, bank account, and investment options. Additionally, the color scheme has been updated to provide a more cohesive and professional look.

2. Security Enhancements

Security is a top priority for Cash App, and the company has made significant changes to enhance the safety of its users. One of the most notable improvements is the introduction of two-factor authentication (2FA). This feature adds an extra layer of security by requiring users to enter a verification code sent to their phone number or email address when logging in.

In addition to 2FA, Cash App has also implemented other security measures, such as biometric authentication (fingerprint or face recognition) for eligible users. The app now offers real-time notifications for transactions, allowing users to monitor their account activity and detect any suspicious activity promptly.

3. New Features and Services

Cash App has continuously expanded its range of features and services to cater to the evolving needs of its users. Here are some of the latest additions:

-

Stock Trading: Cash App now allows users to buy and sell stocks directly within the app. This feature is particularly appealing to younger investors who are looking for a convenient way to invest in the stock market.

-

Bitcoin Purchases: Users can now purchase Bitcoin directly through Cash App, making it easier to invest in the cryptocurrency market.

-

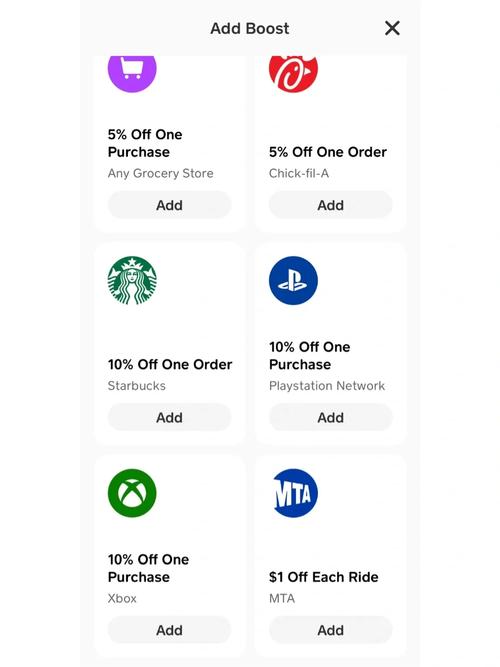

Debit Card: Cash App offers a free Visa debit card that can be used to make purchases, withdraw cash from ATMs, and receive direct deposits.

-

Payday Loans: Cash App has introduced a payday loan feature, allowing users to borrow money up to $250 with an interest rate of 10% per month.

4. Pricing and Fees

Cash App has a straightforward pricing structure, with minimal fees for most transactions. Here’s a breakdown of the key fees:

| Transaction Type | Fee |

|---|---|

| Bank Account Deposits | Free |

| Debit Card Purchases | Free |

| Bitcoin Purchases | 1.49% of the transaction amount |

| Stock Trades | $1 per trade |

| Payday Loans | 10% per month |

It’s important to note that Cash App does not charge any fees for sending or receiving money between users. However, there may be fees associated with certain transactions, such as ATM withdrawals or international transfers.

5. Customer Support

Cash App offers robust customer support to assist users with any issues or questions they may have. The app provides a comprehensive help center with FAQs, tutorials, and step-by-step guides. Users can also contact customer support directly through the app, via email, or by phone.

In addition to the app’s support resources, Cash App has a dedicated community forum where users can share tips, ask questions, and provide feedback. This community-driven approach helps to create a supportive and informative environment for all users.

In conclusion, Cash App has undergone several significant changes over the years, aiming to improve