CashApp Company: A Comprehensive Overview

CashApp is a popular mobile payment service that has gained significant traction in recent years. It allows users to send and receive money, invest in stocks, and even purchase Bitcoin. In this detailed overview, we will explore the various aspects of CashApp, including its features, benefits, and limitations.

How Does CashApp Work?

CashApp operates as a mobile payment platform that enables users to send and receive money through their smartphones. To get started, users need to download the CashApp app, create an account, and link their bank account or credit/debit card. Once the account is set up, users can easily send money to friends, family, or businesses by entering their CashApp username or scanning their QR code.

One of the standout features of CashApp is its ability to facilitate peer-to-peer (P2P) transactions. Users can send and receive money instantly, making it a convenient option for splitting bills, paying back friends, or sending money to loved ones. Additionally, CashApp offers a unique feature called “CashTags,” which allows users to share their CashApp username with others without the need for a phone number or email address.

Features and Benefits

CashApp offers a range of features and benefits that make it a popular choice among users. Here are some of the key features:

-

Instant Money Transfers: Users can send and receive money instantly, making it a convenient option for urgent transactions.

-

Bitcoin Purchases: CashApp allows users to purchase Bitcoin directly within the app, making it easy to invest in cryptocurrency.

-

Stock Investments: Users can invest in stocks through CashApp, with the ability to buy fractional shares.

-

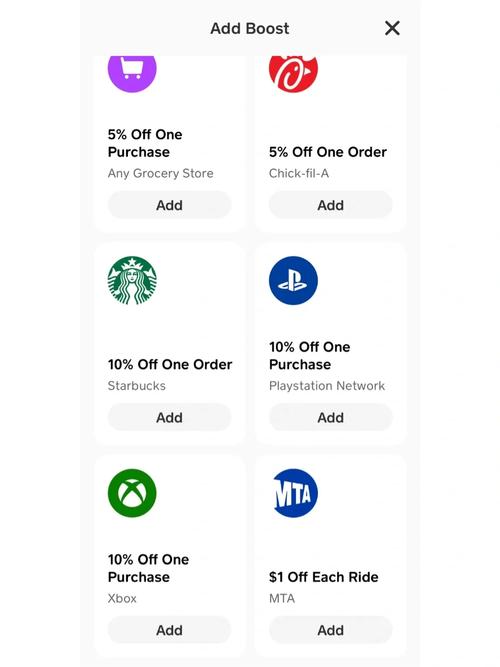

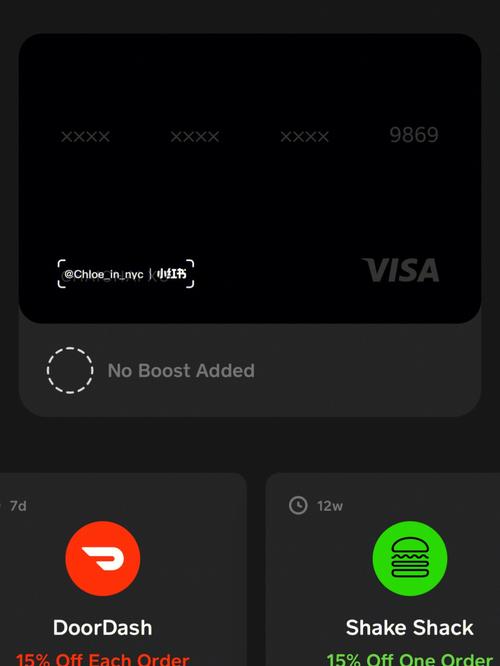

Debit Card: CashApp offers a free Visa debit card that can be used to make purchases, withdraw cash from ATMs, and receive direct deposits.

-

Direct Deposit: Users can set up direct deposit to receive their paychecks directly into their CashApp account.

-

Splitting Bills: CashApp makes it easy to split bills with friends and family, with the option to request or send money directly through the app.

These features make CashApp a versatile financial tool that can be used for a variety of purposes, from personal transactions to investment opportunities.

Benefits of Using CashApp

There are several benefits to using CashApp, including:

-

Convenience: CashApp is easy to use and can be accessed from anywhere, making it a convenient option for managing finances on the go.

-

Security: CashApp uses advanced encryption and security measures to protect users’ financial information.

-

Low Fees: CashApp offers low fees for transactions, with no monthly subscription fees or hidden charges.

-

Community: CashApp has a strong community of users who share tips, advice, and resources to help each other succeed financially.

These benefits make CashApp an attractive option for those looking for a simple, secure, and cost-effective way to manage their finances.

Limitations of CashApp

While CashApp offers many benefits, it also has some limitations:

-

Availability: CashApp is only available in the United States, so users outside of the country cannot use the service.

-

Transaction Limits: CashApp imposes daily and weekly limits on the amount of money users can send and receive, which may be a drawback for some users.

-

No International Transactions: CashApp does not support international money transfers, so users cannot send or receive money from outside the United States.

-

Lack of Customer Support: CashApp offers limited customer support options, which may be a concern for some users.

These limitations should be considered when deciding whether CashApp is the right financial tool for your needs.

Comparison with Other Payment Services

When comparing CashApp to other payment services, such as PayPal or Venmo, there are several key differences:

| Payment Service | CashApp | PayPal |

|---|