Understanding the Basics of Cashing a Check

Cashing a check is a common financial transaction that many people encounter at some point in their lives. Whether you’ve received a check as a gift, a payment, or a refund, knowing how to cash it can save you time and hassle. In this article, we’ll delve into the process of cashing a check, the fees involved, and the best places to do it.

What is a Check?

A check is a written, dated, and signed instrument that instructs a bank to pay a specific amount of money from the account of the person who wrote the check (the drawer) to the person or entity named on the check (the payee). Checks are a popular form of payment due to their convenience and security.

How to Cash a Check

Cashing a check is relatively straightforward. Here’s a step-by-step guide:

-

Endorse the back of the check: Sign your name on the back of the check in the space provided. This is known as endorsing the check, and it allows the bank to know who is cashing it.

-

Take the check and a valid government-issued photo ID to a bank or credit union. Some banks may also accept a driver’s license or state ID.

-

Fill out any required forms: Some banks may require you to fill out a deposit slip or other forms. Be sure to provide accurate information.

-

Wait for the funds to clear: The bank will hold the check for a certain period, typically one to three business days, to ensure that the funds are available. Once the funds have cleared, you will receive the cash.

Where to Cash a Check

You can cash a check at various places, including:

-

Banks and credit unions: This is the most common and secure option. You can cash a check at your own bank or any other bank or credit union.

-

Check-cashing stores: These stores specialize in cashing checks and may offer additional services, such as money orders and bill payments. However, they often charge higher fees than banks.

-

Online banks: Some online banks offer check-cashing services, which can be convenient if you prefer to do your banking online.

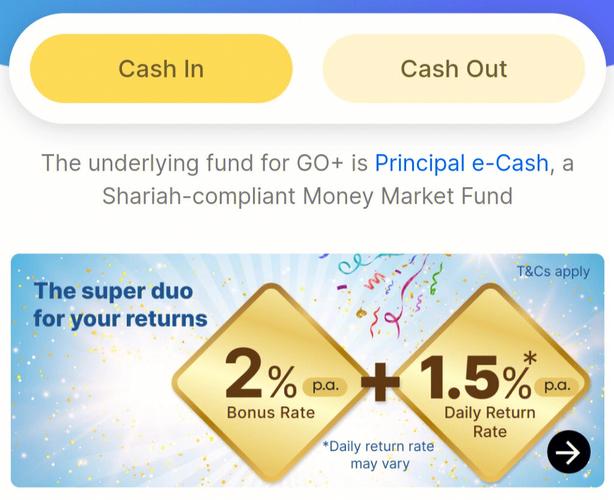

Understanding Check Cashing Fees

When you cash a check, you may be charged a fee, especially if you’re using a non-bank service. Here’s a breakdown of the fees you might encounter:

| Service | Fee |

|---|---|

| Bank or credit union | $0 – $5 |

| Check-cashing store | $5 – $30 or 1-3% of the check amount |

| Online bank | $0 – $5 |

Additional Tips for Cashing a Check

Here are some additional tips to keep in mind when cashing a check:

-

Always keep a copy of the check and the receipt you receive after cashing it.

-

Be cautious when using check-cashing stores, as they may have less secure environments and higher fees.

-

Some banks may require you to have an account with them before you can cash a check.

Cashing a check is a simple process that can be done at various places, but it’s important to understand the fees and options available to you. By following these tips, you can ensure a smooth and hassle-free experience.