Understanding QuickBooks Online Dividend Earned Showing Payment

Managing finances, especially for businesses, can be a complex task. QuickBooks Online, a popular accounting software, offers a variety of features to streamline financial processes. One such feature is the “Dividend Earned Showing Payment” report. This article will delve into what this report entails, how it works, and its significance in your financial management.

What is QuickBooks Online Dividend Earned Showing Payment?

The “Dividend Earned Showing Payment” report in QuickBooks Online is designed to help businesses track and manage dividend payments. Dividends are payments made to shareholders out of a company’s profits. This report shows the dividends earned by shareholders and the payments made to them.

How Does the Report Work?

When you generate the “Dividend Earned Showing Payment” report in QuickBooks Online, it provides a detailed breakdown of the dividends earned by each shareholder. The report includes the following information:

| Shareholder Name | Dividend Earned | Payment Date | Payment Amount |

|---|---|---|---|

| John Doe | $1,000 | 03/01/2023 | $1,000 |

| Jane Smith | $500 | 03/01/2023 | $500 |

This table provides a snapshot of the dividend payments made to shareholders. The report can be customized to show specific time frames and can be filtered by shareholder name or payment date.

Significance of the Report

The “Dividend Earned Showing Payment” report is crucial for several reasons:

-

Transparency: The report ensures that all dividend payments are transparent and accounted for, which is essential for maintaining good relationships with shareholders.

-

Compliance: It helps businesses comply with legal and regulatory requirements regarding dividend payments.

-

Financial Management: The report provides valuable insights into the financial health of the company, particularly in terms of dividend distribution.

Generating the Report

Generating the “Dividend Earned Showing Payment” report in QuickBooks Online is a straightforward process:

-

Log in to your QuickBooks Online account.

-

Click on the “Reports” tab on the left-hand menu.

-

Search for “Dividend Earned Showing Payment” in the search bar.

-

Select the report and customize it as needed.

-

Click “Run Report” to generate the report.

Customizing the Report

QuickBooks Online allows you to customize the “Dividend Earned Showing Payment” report to suit your specific needs. Here are some customization options:

-

Date Range: You can set the report to show dividend payments for a specific time frame.

-

Shareholder Filter: You can filter the report to show dividend payments for specific shareholders.

-

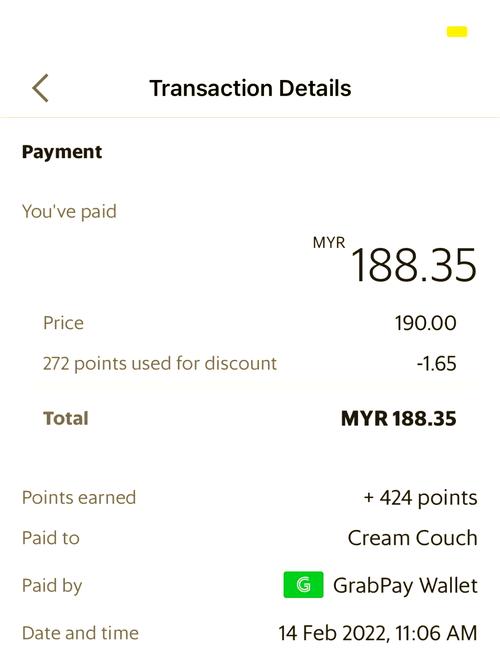

Payment Method: You can include or exclude dividend payments made through specific methods, such as checks or electronic transfers.

Conclusion

The “Dividend Earned Showing Payment” report in QuickBooks Online is a valuable tool for businesses looking to manage and track dividend payments. By providing a detailed breakdown of dividend earnings and payments, the report helps ensure transparency, compliance, and effective financial management.