Understanding the Book

Have you ever wondered how to make money? The book “Rich Dad Poor Dad” by Robert T. Kiyosaki offers a unique perspective on wealth accumulation and financial education. This article will delve into the core principles of the book and provide you with actionable steps to make money and build wealth.

Rich Dad, Poor Dad: The Authors

“Rich Dad Poor Dad” is authored by Robert T. Kiyosaki, an entrepreneur and investor. The book is based on his personal experiences with two men who influenced his financial thinking: his “rich dad,” a successful entrepreneur, and his “poor dad,” a highly educated but financially struggling schoolteacher.

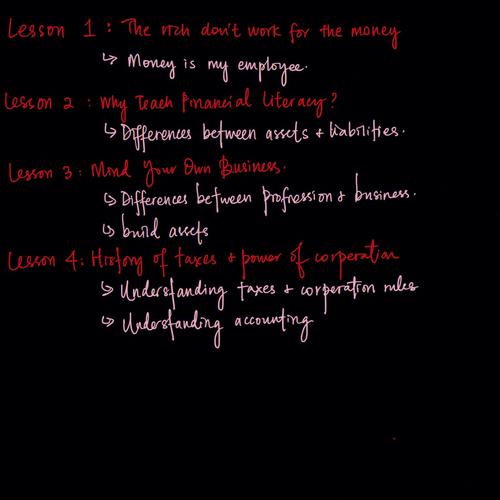

Key Principles of the Book

Here are some of the key principles outlined in “Rich Dad Poor Dad”:

| Principle | Description |

|---|---|

| Financial Education | Learn about money, investments, and business to make informed decisions. |

| Assets vs. Liabilities | Focus on acquiring assets that generate income rather than liabilities that drain your resources. |

| Investing in Yourself | Invest in your education, skills, and health to increase your earning potential. |

| Passive Income | Build a business or investment portfolio that generates income without requiring constant effort. |

| Financial Freedom | Work towards financial independence so you can live the life you want without relying on a job. |

How to Make Money: Actionable Steps

Now that you understand the key principles of “Rich Dad Poor Dad,” here are some actionable steps to help you make money:

1. Educate Yourself

Start by reading books, attending workshops, and seeking advice from successful individuals in the field of finance and business. Some recommended books include “The Intelligent Investor” by Benjamin Graham and “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko.

2. Create a Budget

Track your income and expenses to understand where your money is going. Create a budget that allocates funds for savings, investments, and expenses. Use tools like Mint or YNAB to help you manage your finances.

3. Focus on Assets

Identify assets that can generate income for you. This could include rental properties, stocks, bonds, or starting a business. Remember, the goal is to create a passive income stream that will continue to grow over time.

4. Invest in Yourself

Invest in your education, skills, and health. This will increase your earning potential and make you more valuable to employers or clients. Consider taking online courses, attending workshops, or pursuing advanced degrees.

5. Build a Network

Networking can open doors to new opportunities and partnerships. Attend industry events, join professional organizations, and connect with like-minded individuals. Use social media platforms like LinkedIn to expand your network.

6. Stay Disciplined

Building wealth takes time and discipline. Stay focused on your goals and avoid making impulsive decisions. Review your financial plan regularly and make adjustments as needed.

Conclusion

“Rich Dad Poor Dad” offers valuable insights into the world of wealth accumulation and financial education. By following the principles outlined in the book and taking actionable steps, you can make money and build a prosperous future for yourself and your family.