How Do Online Payment Companies Make Money?

Online payment companies have revolutionized the way we conduct financial transactions. They have made it easier, faster, and more secure to send and receive money across the globe. But how do these companies generate revenue? Let’s delve into the various ways online payment companies make money.

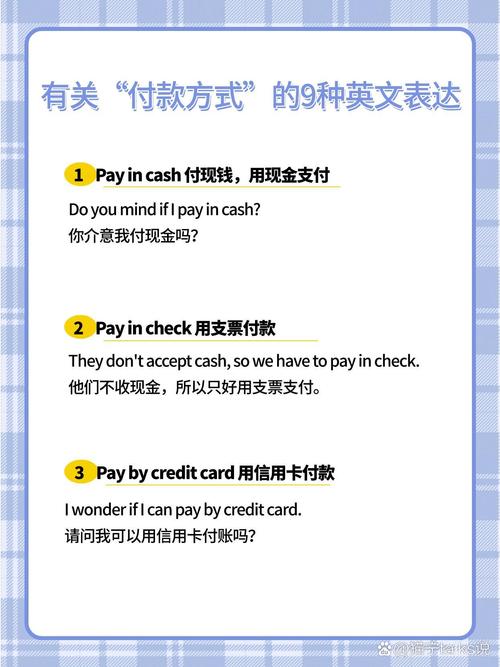

Transaction Fees

The most common way online payment companies make money is through transaction fees. When you make a payment using a service like PayPal, Venmo, or Stripe, these companies charge a small fee for processing the transaction. The fee is usually a percentage of the transaction amount, and it can vary depending on the service and the type of transaction.

| Payment Service | Transaction Fee |

|---|---|

| PayPal | 1.9% + $0.30 per transaction |

| Stripe | 0.5% – 2.9% + $0.30 per transaction |

| Payoneer | 1.9% + $0.35 per transaction |

Transaction fees can be a significant source of revenue for online payment companies, especially when they process a large number of transactions. For example, PayPal processed over 21 billion transactions in 2020, generating $2.9 billion in revenue from transaction fees alone.

Subscription Models

Some online payment companies offer subscription-based services, where users pay a monthly or annual fee to access premium features. These features may include higher transaction limits, priority customer support, or additional security measures.

For instance, PayPal offers a Premium plan for $4.99 per month, which includes a higher transaction limit, identity theft protection, and other benefits. Similarly, Stripe offers a range of pricing plans, including a pay-as-you-go plan and a custom plan for high-volume users.

Merchandising and Advertising

Online payment companies also generate revenue through merchandising and advertising. They may partner with merchants to offer exclusive deals or discounts to their customers. Additionally, they can display targeted ads based on the user’s transaction history and preferences.

For example, PayPal has a partnership with eBay, where it offers a PayPal Preferred program that provides discounts and special offers to eBay users. Stripe also offers a range of marketing tools and services to help businesses grow their online presence.

Interest on Borrowed Funds

Some online payment companies offer lending services, allowing users to borrow money and pay it back over time. These companies earn interest on the borrowed funds, which can be a substantial source of revenue.

For instance, PayPal offers a credit line called PayPal Credit, which allows users to make purchases and pay them off over time. PayPal earns interest on the outstanding balance, generating additional revenue.

Merger and Acquisition Activity

Online payment companies often engage in merger and acquisition (M&A) activity to expand their market reach and diversify their revenue streams. By acquiring other companies, they can gain access to new customers, technology, and expertise.

For example, PayPal acquired Venmo in 2013, which helped it expand its peer-to-peer payment services. Stripe has also made several strategic acquisitions, including the purchase of Paystack, a payment processing company in Africa.

Conclusion

In conclusion, online payment companies generate revenue through a variety of sources, including transaction fees, subscription models, merchandising, advertising, interest on borrowed funds, and M&A activity. These diverse revenue streams allow them to offer a wide range of services and cater to the needs of different customers. As the digital economy continues to grow, online payment companies are likely to find new ways to make money and solidify their position as the preferred choice for financial transactions.