Understanding Cash Wallet: A Comprehensive Guide

Cash wallet, a term that has become increasingly popular in the digital age, refers to a virtual storage space for your money. It’s a convenient and secure way to manage your finances, whether you’re making online purchases, sending money to friends, or simply keeping track of your spending. In this article, we’ll delve into the various aspects of cash wallet, helping you understand how it works, its benefits, and how to make the most out of it.

How Does a Cash Wallet Work?

A cash wallet operates similarly to a physical wallet, but instead of storing cash and cards, it stores digital currencies and payment information. When you create a cash wallet, you typically need to link it to a bank account or credit card. This allows you to transfer funds into your wallet, which can then be used for various transactions.

Here’s a step-by-step guide on how a cash wallet works:

-

Create an account: Sign up for a cash wallet service and provide the necessary information, such as your name, email address, and phone number.

-

Link a payment method: Connect your bank account or credit card to your cash wallet. This will allow you to fund your wallet and make purchases.

-

Transfer funds: Move money from your bank account or credit card to your cash wallet. You can do this by transferring a specific amount or setting up a recurring transfer.

-

Make purchases: Use your cash wallet to pay for online purchases, in-store transactions, or bill payments. Simply select your cash wallet as the payment method and enter your PIN or use biometric authentication.

-

Track your spending: Many cash wallet services offer a spending tracker, allowing you to monitor your expenses and stay within your budget.

Benefits of Using a Cash Wallet

There are several advantages to using a cash wallet:

-

Convenience: With a cash wallet, you can make purchases and send money from anywhere, at any time, as long as you have an internet connection.

-

Security: Cash wallets use advanced encryption and security measures to protect your financial information, making it difficult for hackers to gain access.

-

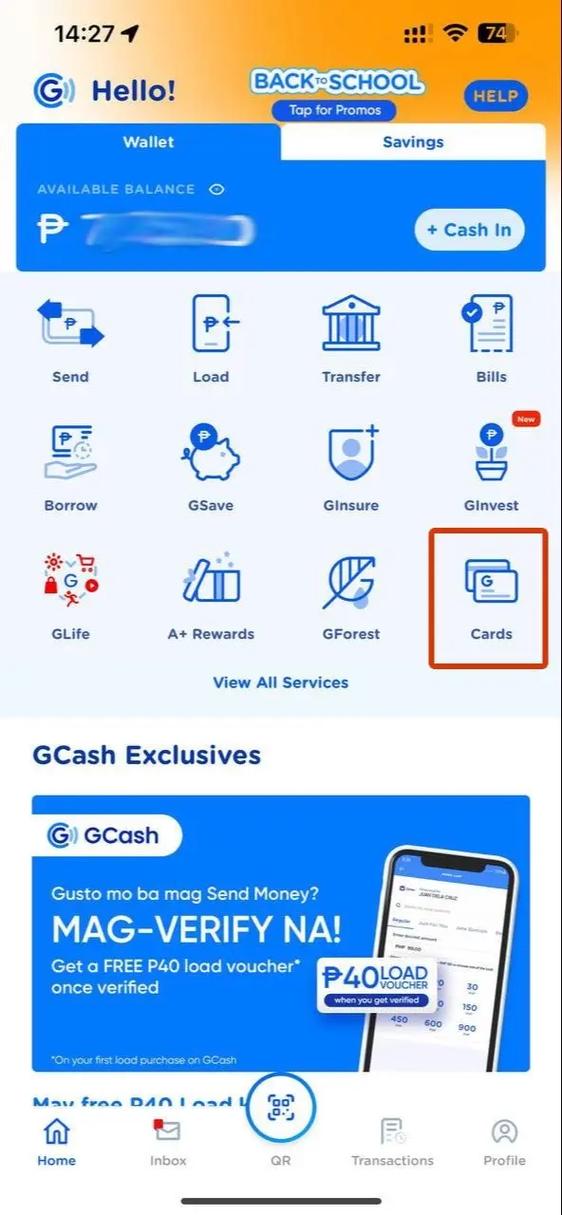

Accessibility: Many cash wallet services offer mobile apps, allowing you to manage your finances on the go.

-

Multiple payment options: Cash wallets typically support various payment methods, including credit cards, debit cards, and bank transfers.

-

Rewards and discounts: Some cash wallet services offer rewards programs, cashback, and discounts on purchases.

Popular Cash Wallet Services

Several cash wallet services are available, each with its unique features and benefits. Here are some of the most popular ones:

| Service | Features | Best For |

|---|---|---|

| Apple Pay | Secure, easy to use, supports various payment methods | iPhone users looking for a seamless payment experience |

| Google Wallet | Integrates with Google services, supports various payment methods | Users of Google services and Android devices |

| PayPal | Global reach, supports various payment methods, user-friendly interface | Online shoppers and businesses |

| Alipay | Popular in China, supports various payment methods, integrates with social media | Chinese users and businesses |

How to Choose the Right Cash Wallet for You

When choosing a cash wallet, consider the following factors:

-

Payment methods: Ensure the cash wallet supports your preferred payment methods, such as credit cards, debit cards, and bank transfers.

-

Security: Look for a cash wallet with strong security measures, such as encryption and two-factor authentication.

-

Accessibility: Consider whether the cash wallet has a mobile app