Understanding Cash App Banks

Cash App, a popular mobile payment service, has transformed the way people manage their finances. But what exactly does Cash App Banks entail? Let’s dive into the details and explore the various aspects of this innovative financial platform.

What is Cash App?

Cash App, originally known as Square Cash, is a point-of-sale payment service developed by Square, Inc. Launched in 2013, it allows users to send and receive money, make purchases, and invest in stocks and cryptocurrencies. The app has gained immense popularity, boasting over 36 million active users as of 2020.

How Does Cash App Banks Work?

Cash App Banks refers to the banking services offered by Cash App. These services include point-of-sale payments, direct deposits, Cash Card, and investment options. Here’s a breakdown of each feature:

| Feature | Description |

|---|---|

| Point-of-Sale Payments | Users can make purchases at participating merchants using their Cash App account. |

| Direct Deposits | Users can receive their paychecks, government benefits, and other payments directly into their Cash App account. |

| Cash Card | Cash App offers a virtual and physical debit card that can be used for purchases, cash withdrawals, and ATM access. |

| Investments | Users can invest in stocks, ETFs, and cryptocurrencies through Cash App’s investment platform. |

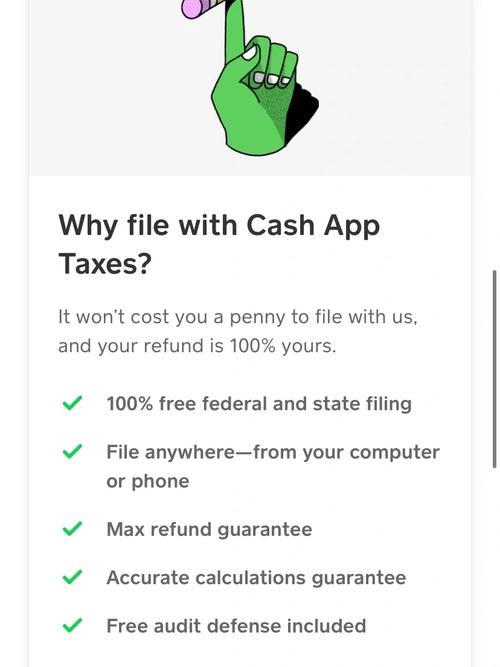

Benefits of Cash App Banks

There are several benefits to using Cash App Banks:

-

Convenience: With Cash App Banks, you can manage your finances, make purchases, and invest all in one place.

-

Accessibility: Cash App Banks offer services to individuals who may not have traditional banking options.

-

Security: Cash App uses advanced security measures to protect your financial information.

-

Transparency: Cash App provides real-time transaction alerts and easy-to-understand financial reports.

How to Get Started with Cash App Banks

Getting started with Cash App Banks is simple:

-

Download the Cash App from the App Store or Google Play.

-

Open the app and sign up for an account.

-

Link your bank account or credit/debit card to the app.

-

Start using the app to make purchases, receive payments, and invest.

Is Cash App Banks Right for You?

Cash App Banks may be a great fit for you if:

-

You’re looking for a convenient and accessible way to manage your finances.

-

You want to invest in stocks, ETFs, or cryptocurrencies.

-

You’re interested in exploring alternative banking options.

Conclusion

Cash App Banks offers a range of financial services that cater to the needs of modern consumers. With its user-friendly interface, convenient features, and innovative investment options, Cash App Banks is a valuable tool for managing your finances. Whether you’re looking to make purchases, receive payments, or invest, Cash App Banks has something to offer.