Can You Use Cash App Without a Card?

Are you considering using Cash App but worried about not having a card? Don’t worry, you’re not alone. Many people are curious about the possibility of using Cash App without a card. In this detailed guide, we’ll explore various aspects of using Cash App without a card, including its features, limitations, and how to set it up. Let’s dive in!

Understanding Cash App

Cash App is a mobile payment service that allows users to send, receive, and spend money. It’s a popular choice for peer-to-peer transactions, bill payments, and even investing. While having a card is convenient, it’s not a requirement to use Cash App. Let’s look at the different ways you can use Cash App without a card.

Using Cash App Without a Card: The Basics

1. Bank Account Linking: The most common way to use Cash App without a card is by linking a bank account. This allows you to send and receive money directly from your bank account. To do this, simply open the Cash App, tap the “Bank” tab, and follow the instructions to link your account.

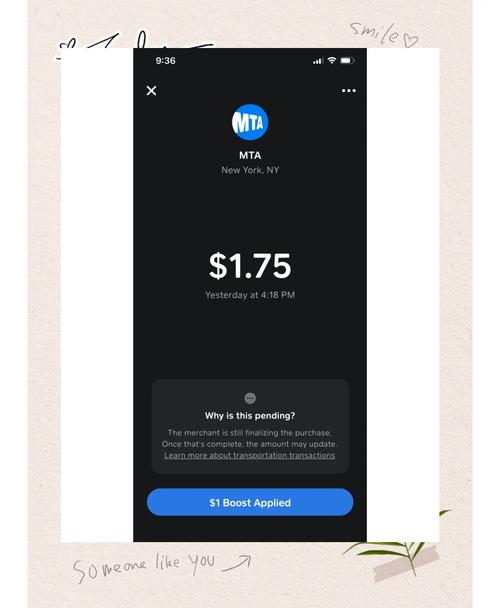

2. Cash Card: Although not necessary, you can also request a Cash Card, which is a Visa debit card linked to your Cash App account. This card can be used for purchases, ATM withdrawals, and more. However, you can still use Cash App without a Cash Card.

3. Peer-to-Peer Transfers: Cash App’s primary feature is peer-to-peer transfers. You can send and receive money from friends, family, or anyone with a Cash App account. This can be done by entering their $Cashtag or phone number.

Features of Using Cash App Without a Card

1. No Card Required: As mentioned earlier, you can use Cash App without a card. This is beneficial for those who prefer not to carry a card or have difficulty obtaining one.

2. Easy to Set Up: Linking a bank account is a straightforward process, making it easy for anyone to start using Cash App without a card.

3. No Monthly Fees: Cash App doesn’t charge monthly fees for using the app without a card. However, there may be fees for certain transactions, such as ATM withdrawals or cash reloads.

Limitations of Using Cash App Without a Card

1. Limited Purchasing Power: Without a Cash Card, you may have limited purchasing power. While you can still use Cash App for peer-to-peer transfers and bill payments, you won’t be able to use it for in-store purchases.

2. ATM Access: Without a Cash Card, you won’t have access to ATMs. However, you can still withdraw cash from ATMs by using your linked bank account.

3. Limited Support: Some users have reported that customer support may be less helpful when using Cash App without a card.

How to Set Up Cash App Without a Card

1. Download the App: First, download the Cash App from the App Store or Google Play Store.

2. Create an Account: Open the app and create an account by entering your phone number and email address.

3. Verify Your Identity: Cash App requires you to verify your identity by entering your full name, date of birth, and the last four digits of your Social Security number.

4. Link a Bank Account: Tap the “Bank” tab and follow the instructions to link your bank account. This will allow you to send, receive, and spend money without a card.

Conclusion

Using Cash App without a card is possible and offers several benefits, such as ease of setup and no monthly fees. However, it’s important to be aware of the limitations, such as limited purchasing power and ATM access. By understanding these aspects, you can make an informed decision about whether Cash App is the right payment solution for you.

| Feature | Description |

|---|---|

| No Card Required | Use Cash App without a physical card |

| Bank Account Linking | Link your bank account for transactions |

| Cash Card (Optional) | Request a Cash Card for additional

|