Cash App Investing LLC: A Comprehensive Overview

Cash App Investing LLC has emerged as a popular platform for individuals looking to diversify their investment portfolios. With its user-friendly interface and a wide range of investment options, it has gained a significant following. In this article, we will delve into the various aspects of Cash App Investing LLC, including its features, benefits, and limitations.

Understanding Cash App Investing LLC

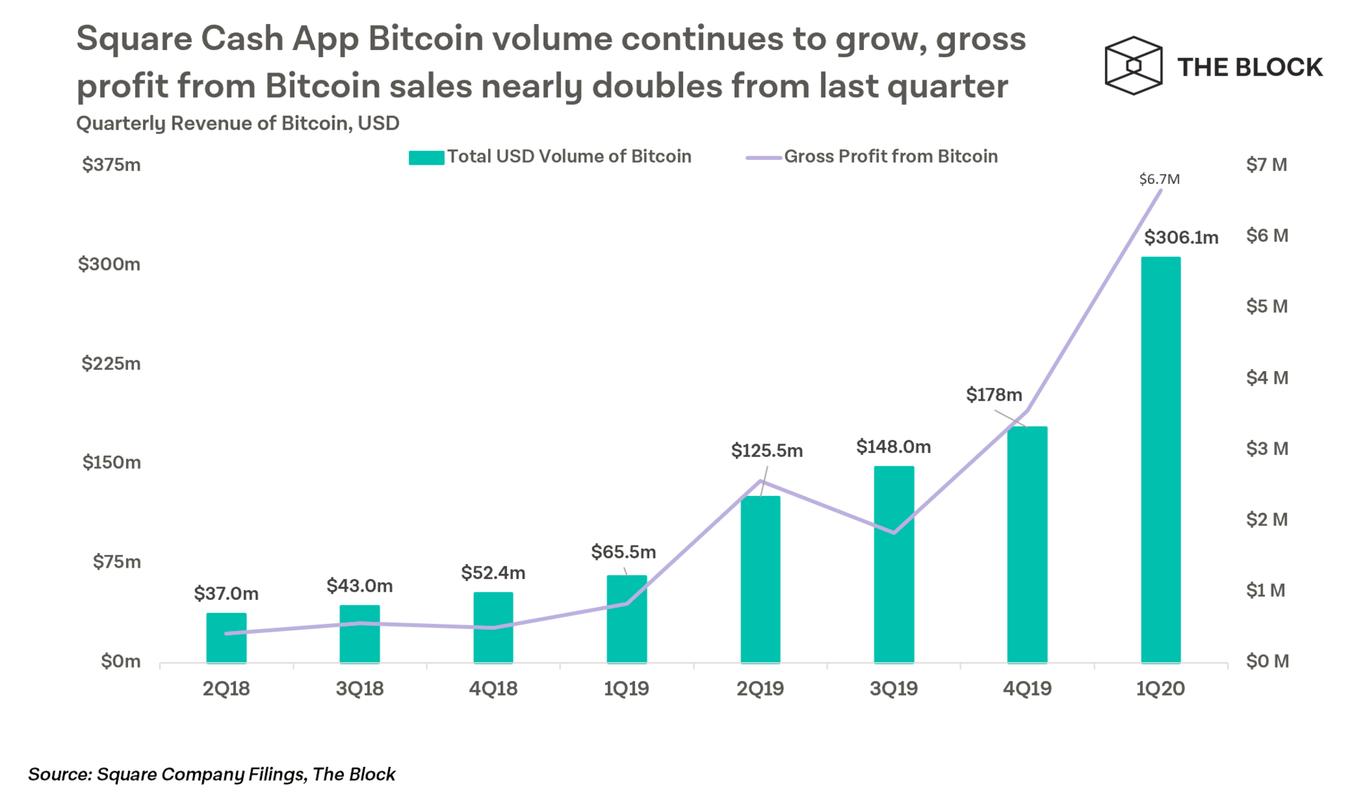

Cash App Investing LLC is a division of Square, Inc., a financial services company founded by Jack Dorsey. It allows users to invest in a variety of assets, including stocks, ETFs, and cryptocurrencies. The platform is designed to be accessible to both beginners and experienced investors, offering a seamless experience for managing investments.

Features of Cash App Investing LLC

Here are some of the key features that make Cash App Investing LLC stand out:

-

Easy-to-use interface: The platform is designed to be user-friendly, making it easy for users to navigate and manage their investments.

-

Wide range of investment options: Users can choose from a variety of stocks, ETFs, and cryptocurrencies, allowing them to diversify their portfolios.

-

Low fees: Cash App Investing LLC charges a low fee of 0.25% per trade, which is significantly lower than many other investment platforms.

-

Real-time updates: Users receive real-time updates on their investments, allowing them to stay informed and make informed decisions.

-

Robo-advisor: The platform offers a robo-advisor feature that helps users create and manage their investment portfolios based on their risk tolerance and investment goals.

Benefits of Using Cash App Investing LLC

Using Cash App Investing LLC offers several benefits, including:

-

Accessibility: The platform is accessible through the Cash App, making it easy for users to manage their investments on the go.

-

Low fees: The low fees charged by Cash App Investing LLC can help users save money over time.

-

Robo-advisor: The robo-advisor feature can help users create and manage their investment portfolios without the need for a financial advisor.

-

Community support: Cash App Investing LLC has a strong community of users who share tips, insights, and advice, making it easier for users to learn and grow their investments.

Limitations of Cash App Investing LLC

While Cash App Investing LLC offers many benefits, it also has some limitations:

-

Limited investment options: Compared to some other investment platforms, Cash App Investing LLC offers a limited range of investment options.

-

No access to bonds or mutual funds: Users cannot invest in bonds or mutual funds through Cash App Investing LLC.

-

No professional financial advice: While the robo-advisor feature can help users create and manage their portfolios, it does not provide personalized financial advice.

How to Get Started with Cash App Investing LLC

Getting started with Cash App Investing LLC is a straightforward process:

-

Download the Cash App on your smartphone.

-

Sign up for an account and link your bank account.

-

Deposit funds into your Cash App Investing LLC account.

-

Choose your investment options and start investing.

Table: Comparison of Cash App Investing LLC with Other Investment Platforms

| Platform | Investment Options | Fee Structure | Robo-advisor |

|---|---|---|---|

| Cash App Investing LLC | Stocks, ETFs, Cryptocurrencies | 0.25% per trade | Yes |

| Robinhood | Stocks, ETFs, Cryptocurrencies | Free trades | No |