Understanding the Basics of Cash App and Zelle

Cash App and Zelle are two popular digital payment platforms that have gained significant traction in recent years. Both platforms offer users the convenience of sending and receiving money quickly and securely. If you’re wondering whether you can send money from Zelle to Cash App, this article will provide you with a comprehensive guide to help you understand the process and its intricacies.

What is Cash App?

Cash App is a mobile payment service developed by Square, Inc. It allows users to send, receive, and request money from friends and family. The app also offers a range of other features, including the ability to invest in stocks, purchase Bitcoin, and pay bills. To use Cash App, you need to download the app, create an account, and link a bank account or a credit/debit card.

What is Zelle?

Zelle is a person-to-person (P2P) payment service that allows users to send and receive money directly from their bank accounts. It is available through most major banks in the United States. Zelle is a convenient way to send money to friends, family, or businesses without sharing sensitive financial information.

Can You Send Money from Zelle to Cash App?

Yes, you can send money from Zelle to Cash App. However, the process is not as straightforward as sending money from one Zelle user to another. Here’s how you can do it:

Step-by-Step Guide to Sending Money from Zelle to Cash App

-

Log in to your Zelle account on your bank’s website or mobile app.

-

Enter the recipient’s email address or phone number associated with their Cash App account.

-

Enter the amount of money you want to send.

-

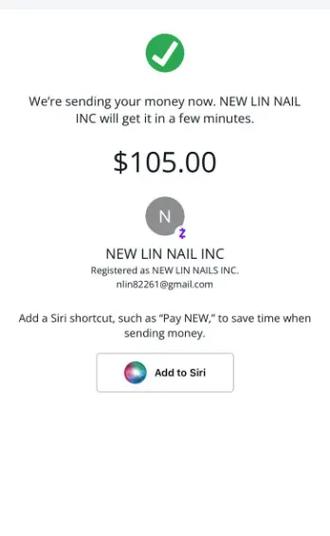

Review the transaction details and confirm the payment.

-

The recipient will receive a notification in their Cash App that they have received money. They can then withdraw the funds to their bank account or use them within the Cash App.

Important Considerations

Before you proceed with sending money from Zelle to Cash App, here are some important considerations to keep in mind:

-

Transaction Fees: Both Zelle and Cash App may charge transaction fees for sending money. Be sure to check the fees associated with each platform before initiating a transaction.

-

Processing Time: The time it takes for the money to be transferred from Zelle to Cash App can vary. It may take a few minutes to several hours, depending on the banks involved.

-

Recipient’s Account: Ensure that the recipient has a Cash App account and that their email address or phone number is correctly linked to their account.

-

Security: Both Zelle and Cash App prioritize the security of your financial information. However, it’s always a good idea to keep your login credentials and account information confidential.

Table: Comparison of Zelle and Cash App Features

| Feature | Zelle | Cash App |

|---|---|---|

| Availability | Available through most major banks | Available for download on iOS and Android devices |

| Transaction Fees | May charge fees depending on the bank | May charge fees depending on the transaction type |

| Payment Methods | Bank account | Bank account, credit/debit card, and Bitcoin |

| Additional Features | Person-to-person payments | Investing in stocks, purchasing Bitcoin, and paying bills |

Conclusion

While it is possible to send money from Zelle to Cash App, it’s important to understand the process and its limitations. By following the steps outlined in this article and considering the important factors, you can ensure a smooth and secure transaction. Always keep in mind the fees, processing time, and security measures associated