Casha App: A Comprehensive Guide for Users

Are you looking for a reliable and convenient mobile banking solution? Look no further than the Casha app. This innovative app has revolutionized the way people manage their finances, offering a wide range of features and services. In this detailed guide, we will explore the various aspects of the Casha app, from its user interface to its security measures, to help you make an informed decision about whether it’s the right banking app for you.

User Interface and Design

The Casha app boasts a sleek and intuitive user interface that makes navigating through its features a breeze. Upon opening the app, you’ll be greeted with a clean and organized homepage that displays your account balance, recent transactions, and quick access to popular features like bill payments and money transfers. The app’s design is user-friendly, with easy-to-read fonts and a color scheme that is both modern and professional.

One of the standout features of the Casha app is its customizable dashboard. You can personalize your homepage by adding or removing widgets that display the information you find most relevant, such as your savings account balance, spending categories, or upcoming bills.

Features and Services

The Casha app offers a comprehensive suite of features and services that cater to the needs of both individual and business users. Here are some of the key features:

-

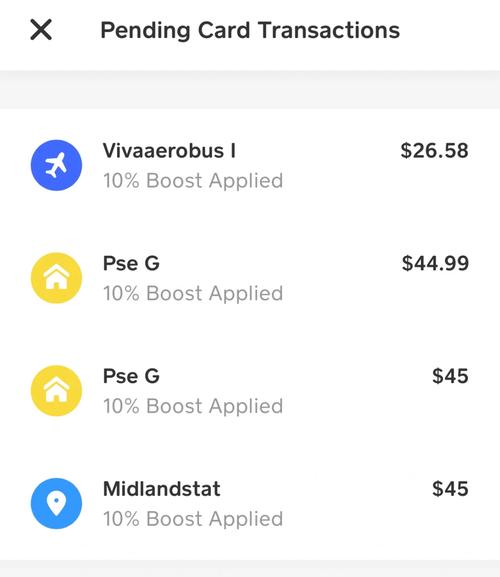

Account Management: With the Casha app, you can easily manage your bank accounts, view transaction history, and set up alerts for low balances or suspicious activity.

-

Mobile Payments: The app supports various mobile payment methods, including Apple Pay, Google Pay, and Samsung Pay, making it convenient to pay for goods and services on the go.

-

Money Transfers: Send and receive money to friends and family using the Casha app’s secure money transfer feature. The app supports multiple currencies and offers competitive exchange rates.

-

Bill Payments: Pay your bills directly from the app, saving you time and reducing the risk of late payments.

-

Investment and Savings: The Casha app offers investment and savings options, allowing you to grow your money and achieve your financial goals.

-

Loan Services: Access personal loans and other financial products through the Casha app, with competitive interest rates and flexible repayment terms.

Security and Privacy

Security is a top priority for the Casha app, and the developers have implemented several measures to protect your financial information. Here are some of the key security features:

-

Two-Factor Authentication: To ensure that only you can access your account, the Casha app requires two-factor authentication, which combines something you know (your password) with something you have (your phone).

-

End-to-End Encryption: All data transmitted between your device and the Casha app is encrypted, keeping your financial information secure from hackers.

-

Regular Security Audits: The Casha app undergoes regular security audits to identify and address any potential vulnerabilities.

Customer Support

The Casha app offers excellent customer support, with multiple channels available to assist you with any issues or questions you may have. Here are the support options:

-

24/7 Chat Support: Access live chat support from the app, where you can get instant assistance with your queries.

-

Email Support: Send an email to the Casha support team, and you’ll receive a response within 24 hours.

-

FAQ Section: The Casha app features a comprehensive FAQ section that covers common questions and issues.

Comparing Casha with Other Banking Apps

When comparing the Casha app with other popular banking apps, there are several factors to consider:

| Feature | Casha App | Other Apps |

|---|---|---|

| User Interface | Intuitive and easy to navigate | Varies by app |

| Security | High-level security measures | Varies by app |