Understanding Cash App: A Comprehensive Guide

Cash App, developed by Square, Inc., has become a popular mobile payment service that offers a variety of financial services. If you’re considering using Cash App or simply want to learn more about it, this detailed guide will provide you with all the information you need.

What is Cash App?

Cash App is a mobile payment application that allows users to send, receive, and store money. It was launched in 2013 and has since grown to offer a range of financial services, including point-of-sale payments, peer-to-peer (P2P) transfers, and investment options.

Key Features of Cash App

Here are some of the key features that make Cash App stand out:

| Feature | Description |

|---|---|

| Point-of-Sale Payments | Cash App allows businesses to accept payments from customers using their mobile devices. |

| Peer-to-Peer Transfers | Users can send and receive money from friends and family directly through the app. |

| Investment Options | Cash App offers users the ability to buy and sell stocks, as well as trade in Bitcoin. |

| Cash Card | The Cash Card is a Visa debit card that can be used to make purchases and withdraw cash from ATMs. |

| Direct Deposits | Users can receive their paychecks directly into their Cash App account. |

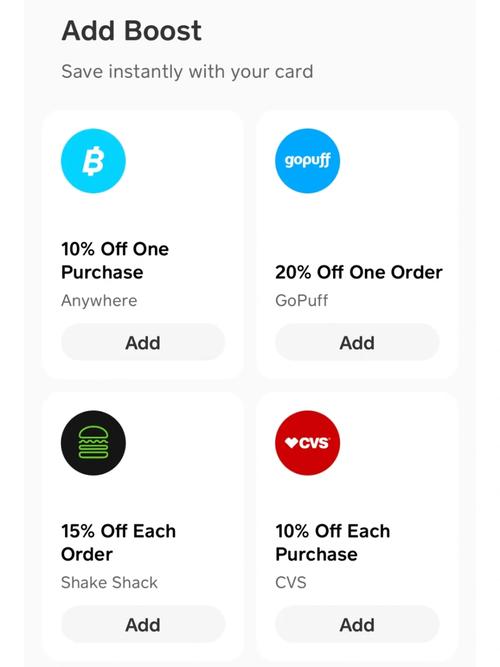

| Cash Boost | Cash Boost offers discounts on purchases made with the Cash Card. |

| Tax Services | Cash App provides users with the ability to file their taxes directly through the app. |

How to Use Cash App

Using Cash App is straightforward. Here’s a step-by-step guide to help you get started:

- Download the Cash App from the App Store or Google Play Store.

- Open the app and enter your phone number to create an account.

- Verify your identity by entering your personal information and taking a photo of your ID.

- Link your bank account or credit/debit card to the app.

- Start sending, receiving, and storing money.

Benefits of Using Cash App

There are several benefits to using Cash App:

- Convenience: Cash App allows you to manage your finances on the go, making it easy to send and receive money at any time.

- Security: The app uses advanced encryption to protect your financial information.

- Investment Opportunities: Cash App offers investment options that can help you grow your money.

- Free Transactions: Many transactions on Cash App are free, including P2P transfers and direct deposits.

Drawbacks of Using Cash App

While Cash App offers many benefits, there are also some drawbacks to consider:

- Transaction Fees: Some transactions, such as sending money with a credit card, may incur fees.

- Limited Availability: Cash App is only available in the United States.

- Customer Service: Some users have reported issues with customer service.

Alternatives to Cash App

If you’re looking for alternatives to Cash App, here are a few options to consider:

- PayPal: PayPal is a popular online payment platform that offers similar services to Cash App.

- Venmo: Venmo is another popular P2P payment app that is similar to Cash App.

- Google Pay: Google Pay allows you to send and receive money, as well as make purchases with your Google account.