Understanding Cash App: A Comprehensive Guide

Cash App is a versatile mobile payment application that has gained significant popularity in recent years. Whether you’re looking to send money to friends, make online purchases, or invest in stocks and cryptocurrencies, Cash App offers a range of features to cater to your needs. In this detailed guide, we’ll explore how to use Cash App effectively and the various functionalities it provides.

How to Use Cash App

Using Cash App is straightforward. Here’s a step-by-step guide to help you get started:

- Download the Cash App from your device’s app store.

- Open the app and enter your phone number to register.

- Enter the verification code sent to your phone to confirm your account.

- Link your bank account or credit card to the app.

- Set up a $Cashtag, which is your unique identifier for receiving payments.

- Choose a username and password for your account.

Once you’ve completed these steps, you can start using Cash App to send and receive money, shop online, and explore other financial services.

Transferring Money with Cash App

One of the primary uses of Cash App is transferring money. Here’s how you can do it:

- Open the Cash App and tap on the “Pay” or “Request” button.

- Enter the recipient’s $Cashtag, phone number, or email address.

- Enter the amount you want to send or request.

- Review the details and tap “Send” or “Request” to complete the transaction.

Cash App supports instant transfers, which allow you to send and receive money in real-time. However, there may be a small fee for instant transfers, depending on your account type.

Using Cash Card for Purchases

Cash App offers a virtual Visa debit card called Cash Card, which you can use for online and in-store purchases. Here’s how to use it:

- Link your Cash Card to your Cash App account.

- Use the Cash Card to make purchases online or in physical stores.

- Monitor your spending and balance through the Cash App.

Cash Card also comes with a Cash Boost feature, which offers cashback on select purchases at participating merchants.

Investing in Stocks and Cryptocurrencies

Cash App allows you to invest in stocks and cryptocurrencies, making it a versatile financial tool. Here’s how to get started:

- Tap on the “Invest” tab in the Cash App.

- Choose the stock or cryptocurrency you want to invest in.

- Enter the amount you want to invest.

- Review the details and tap “Buy” to complete the transaction.

Cash App offers a range of investment options, including individual stocks, ETFs, and popular cryptocurrencies like Bitcoin and Ethereum.

Withdrawing Funds from Cash App

When you need to withdraw funds from your Cash App account, you can do so in a few simple steps:

- Open the Cash App and tap on the “Bank” tab.

- Tap on “Withdraw” and enter the amount you want to withdraw.

- Select your bank account as the withdrawal destination.

- Review the details and tap “Withdraw” to complete the transaction.

Withdrawals to your bank account typically take 1-3 business days, depending on your bank’s processing time.

Additional Features and Benefits

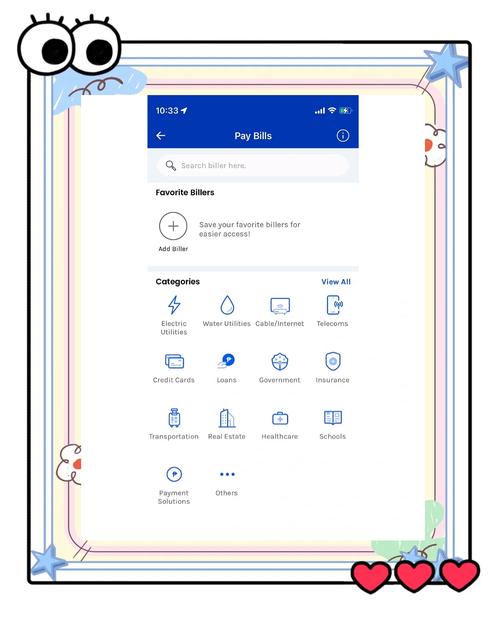

In addition to its core functionalities, Cash App offers several other features and benefits:

- Cash Boost: Earn cashback on select purchases at participating merchants.

- Referral Program: Invite friends to join Cash App and earn rewards for each referral.

- Splitting Bills: Easily split bills with friends and family.

- Security: Cash App uses advanced security measures to protect your financial information.