CashApp: A Comprehensive Guide to the Mobile Payment Platform

CashApp is a popular mobile payment platform that has gained significant traction in recent years. Whether you’re looking to send money to friends, make online purchases, or invest in stocks, CashApp offers a range of features that cater to your needs. In this detailed guide, we’ll explore the various aspects of CashApp, including its features, benefits, and how to use it effectively.

How Does CashApp Work?

CashApp operates as a peer-to-peer payment platform, allowing users to send and receive money quickly and securely. Here’s a step-by-step guide on how it works:

- Download the CashApp app from the App Store or Google Play Store.

- Sign up for an account by entering your personal information and verifying your identity.

- Link your bank account or credit/debit card to your CashApp account.

- Start sending and receiving money by entering the recipient’s $Cashtag or phone number.

CashApp uses end-to-end encryption to ensure the security of your transactions. Additionally, the platform offers a range of features to enhance your experience, such as the ability to request money, set up direct deposits, and invest in stocks.

Key Features of CashApp

CashApp offers a variety of features that make it a versatile payment platform. Here are some of the most notable features:

- $Cashtags: Create a unique $Cashtag for your account, making it easier for others to send you money.

- Direct Deposits: Set up direct deposits from your employer or other sources to receive your paychecks or benefits directly into your CashApp account.

- Stock Investing: Invest in stocks, ETFs, and other assets directly from the CashApp app.

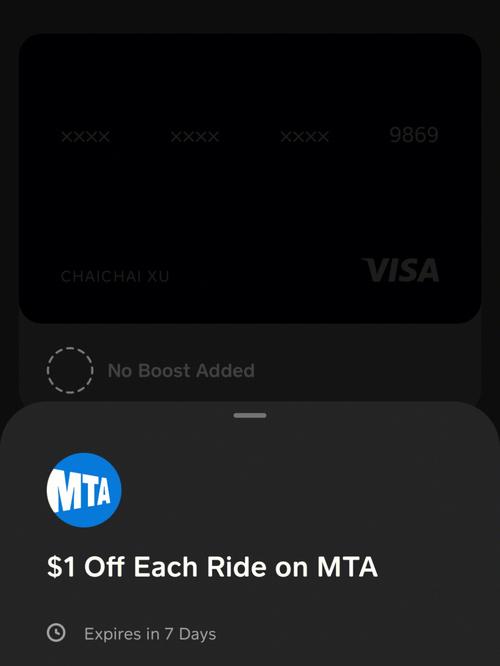

- Debit Card: Get a CashCard, which can be used to make purchases online, in-store, or at ATMs.

- Bill Pay: Pay your bills directly from the CashApp app, including phone, internet, and cable bills.

- Peer-to-Peer Payments: Send and receive money from friends and family with ease.

Benefits of Using CashApp

There are several benefits to using CashApp as your primary payment platform:

- Convenience: Access your account and make transactions from anywhere, at any time.

- Security: CashApp uses advanced encryption and security measures to protect your personal and financial information.

- Low Fees: CashApp offers free transactions for peer-to-peer payments and low fees for other services, such as bill pay and direct deposits.

- Investing Opportunities: Take advantage of the stock market and other investment opportunities directly from the app.

How to Use CashApp Effectively

Here are some tips to help you make the most of your CashApp experience:

- Link Multiple Bank Accounts: Link multiple bank accounts to your CashApp account to have more options for sending and receiving money.

- Use the CashCard: Take advantage of the CashCard to make purchases and withdraw cash from ATMs.

- Set Up Direct Deposits: Set up direct deposits to receive your paychecks or benefits directly into your CashApp account.

- Invest Wisely: Use the stock investing feature to grow your money over time.

Comparing CashApp with Other Payment Platforms

When it comes to mobile payment platforms, CashApp has several competitors, such as PayPal, Venmo, and Square Cash. Here’s a comparison of CashApp with these platforms:

| Feature | CashApp | PayPal | Venmo | Square Cash |

|---|---|---|---|---|

| Peer-to-Peer Payments | Yes | Yes | Yes | Yes

|