Fake Cash App App: A Comprehensive Guide

Are you looking for a reliable and efficient way to manage your finances? Have you ever heard about the Fake Cash App? This article will delve into the details of this app, providing you with a multi-dimensional introduction. From its features to its risks, we’ll cover everything you need to know about the Fake Cash App.

What is the Fake Cash App?

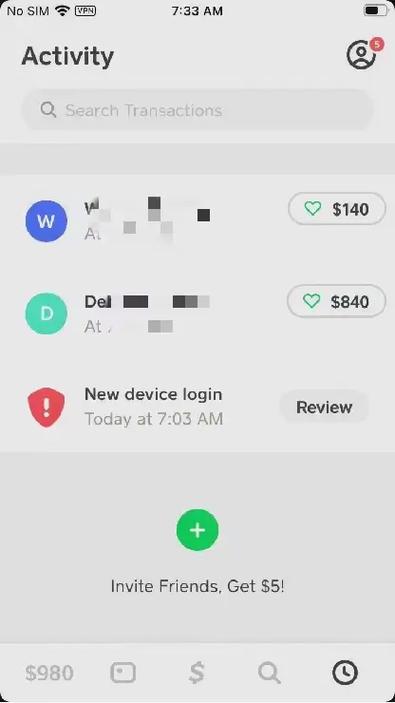

The Fake Cash App is a fraudulent app that mimics the popular mobile payment service, Cash App. It is designed to steal your personal and financial information, leading to identity theft and financial loss. Despite its name, the Fake Cash App has nothing to do with the legitimate Cash App, which is owned by Square, Inc.

How Does the Fake Cash App Work?

The Fake Cash App operates by tricking users into downloading and installing it on their devices. Once installed, the app may ask for access to your contacts, location, and other sensitive information. It may also prompt you to enter your bank account details, credit card information, and social security number.

Here’s how the Fake Cash App typically works:

-

Users download the app from an untrusted source, such as a third-party app store or a malicious website.

-

The app requests access to various permissions, which users may grant without realizing the risks.

-

The app collects sensitive information, such as bank account numbers, credit card details, and social security numbers.

-

The collected information is then used to commit fraud, such as making unauthorized transactions or opening new lines of credit in the user’s name.

Features of the Fake Cash App

While the Fake Cash App is designed to steal your information, it may still have some features that mimic the legitimate Cash App. Here are some of the features you might encounter:

-

Peer-to-peer money transfers

-

Direct deposit

-

Investing options

-

Bill pay

It’s important to note that these features are only present to deceive users and are not intended for legitimate financial transactions.

Risks Associated with the Fake Cash App

Using the Fake Cash App poses several risks, including:

-

Identity theft

-

Financial loss

-

Unauthorized access to your bank account

-

Legal consequences

Identity theft can have long-lasting effects on your credit score and financial stability. Financial loss can occur when your bank account is drained or when new lines of credit are opened in your name. Unauthorized access to your bank account can lead to further financial loss and emotional distress.

How to Identify the Fake Cash App

Identifying the Fake Cash App is crucial to protect yourself from its risks. Here are some tips to help you spot the fake app:

-

Check the app store reviews and ratings. If the app has a low rating or negative reviews, it may be a fake.

-

Look for spelling and grammatical errors in the app’s description and interface.

-

Be cautious of apps that ask for unnecessary permissions, such as access to your contacts, location, and camera.

-

Verify the app’s developer. If the app is not developed by Square, Inc., it is likely a fake.

How to Protect Yourself from the Fake Cash App

Protecting yourself from the Fake Cash App is essential. Here are some steps you can take:

-

Only download apps from trusted sources, such as the official app store.

-

Be cautious of apps that ask for unnecessary permissions.

-

Keep your device’s operating system and apps up to date to ensure you have the latest security patches.

-

Use strong, unique passwords for your online accounts.

-

Monitor your bank and credit card statements for any unauthorized transactions.

Conclusion

The Fake Cash App is a fraudulent