Understanding Cash App: A Comprehensive Guide

Cash App, developed by Square, Inc., has become a popular choice for individuals and businesses alike. This mobile payment service offers a range of features that make it convenient for users to send and receive money, invest, and even manage their finances. Let’s dive into the details of what Cash App is and how it can benefit you.

What is Cash App?

Cash App is a mobile payment application that allows users to send and receive money, invest in stocks and cryptocurrencies, and access various financial services. It was launched in 2013 and has since grown to become a one-stop financial solution for millions of users worldwide.

Key Features of Cash App

Here are some of the key features that make Cash App stand out:

| Feature | Description |

|---|---|

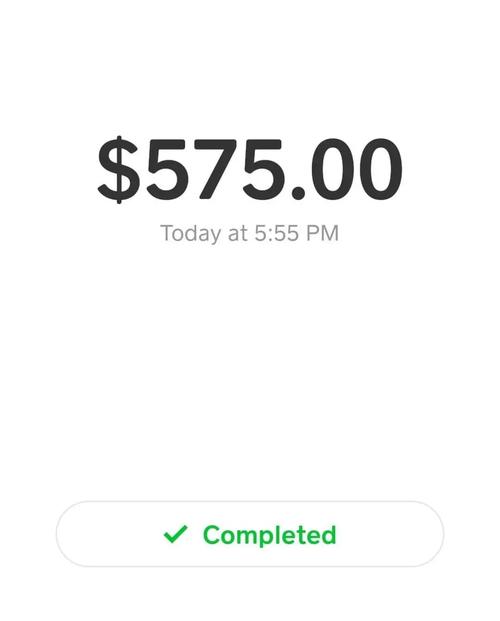

| Peer-to-Peer (P2P) Transfers | Send and receive money instantly with friends, family, and colleagues. |

| Stock Trading | Buy and sell stocks directly within the app. |

| Cryptocurrency Trading | Trade Bitcoin and other cryptocurrencies with ease. |

| Cash Card | Get a Cash Card that can be used for purchases, ATM withdrawals, and more. |

| Direct Deposits | Receive your salary, tax refunds, and other payments directly into your Cash App account. |

| Cash Boost | Get discounts on purchases made with your Cash Card. |

| Tax Preparation | Prepare and file your taxes directly within the app. |

How to Use Cash App

Using Cash App is straightforward. Here’s a step-by-step guide to help you get started:

- Download the Cash App from the App Store or Google Play Store.

- Open the app and sign up for an account.

- Link your bank account or credit/debit card to the app.

- Start sending and receiving money, investing, and using the Cash Card.

Benefits of Using Cash App

There are several benefits to using Cash App:

- Convenience: Send and receive money instantly, anytime, anywhere.

- Security: Your financial information is protected with advanced security measures.

- Investment Opportunities: Access the stock market and cryptocurrencies with ease.

- Financial Management: Track your spending, manage your budget, and prepare your taxes all in one place.

Is Cash App Safe to Use?

Yes, Cash App is safe to use. The app employs advanced security measures, including end-to-end encryption, to protect your financial information. Additionally, Cash App offers two-factor authentication and a $250 fraud liability guarantee.

Alternatives to Cash App

While Cash App is a popular choice, there are other mobile payment and financial services available, such as:

- PayPal: A widely-used payment platform that offers P2P transfers, online shopping, and more.

- Venmo: A social payment app that allows users to send and receive money with friends and family.

- Google Pay: A mobile payment service that allows users to make purchases with their Android devices.

Conclusion

Cash App is a versatile financial tool that offers a range of features to help you manage your money, invest, and access various financial services. With its user-friendly interface, advanced security measures, and convenient features, Cash App is a great choice for anyone looking to simplify their financial life.