The Fastest Way to Make Money on Cash App Stocks

Are you looking to maximize your earnings on Cash App stocks? You’ve come to the right place. In this detailed guide, I’ll walk you through various strategies and tips to help you make the most out of your investments. Whether you’re a beginner or an experienced investor, these methods can help you boost your returns on Cash App stocks.

Understanding Cash App Stocks

Cash App is a popular mobile payment service that also offers a stock trading feature. Users can buy and sell stocks directly through the app, making it convenient for those who prefer a digital investment platform. Before diving into the fastest ways to make money, it’s essential to understand how Cash App stocks work.

Cash App stocks are fractional shares, meaning you can purchase a portion of a stock rather than owning an entire share. This allows you to invest in companies you believe in without having to spend a large amount of money. However, it’s important to note that the value of your investment will fluctuate based on the stock’s performance.

1. Research and Analyze Stocks

One of the fastest ways to make money on Cash App stocks is to conduct thorough research and analysis. By understanding the market and analyzing individual stocks, you can make informed decisions that increase your chances of earning a profit.

Here are some tips to help you research and analyze stocks:

-

Stay updated with financial news and market trends.

-

Examine a company’s financial statements, including its income statement, balance sheet, and cash flow statement.

-

Assess the company’s growth potential, competitive advantage, and management team.

-

Consider the stock’s valuation, such as its price-to-earnings (P/E) ratio and price-to-book (P/B) ratio.

2. Diversify Your Portfolio

Diversification is a key strategy to minimize risk and maximize returns. By investing in a variety of stocks across different sectors and industries, you can reduce the impact of any single stock’s performance on your overall portfolio.

Here are some tips to help you diversify your Cash App stock portfolio:

-

Invest in companies from various sectors, such as technology, healthcare, and finance.

-

Consider investing in both established companies and emerging startups.

-

Allocate your investments based on your risk tolerance and investment goals.

3. Use Stop-Loss Orders

A stop-loss order is an instruction to sell a stock when it reaches a specific price. This strategy helps protect your investments from significant losses. By setting a stop-loss order, you can limit your potential losses while still allowing your investments to grow.

Here’s how to use stop-loss orders on Cash App:

-

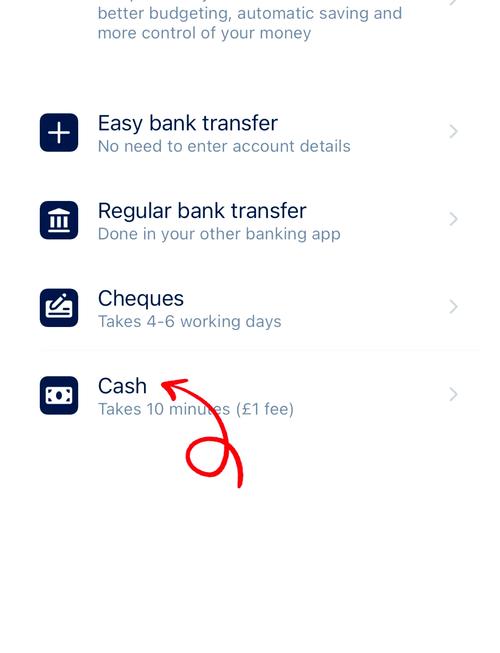

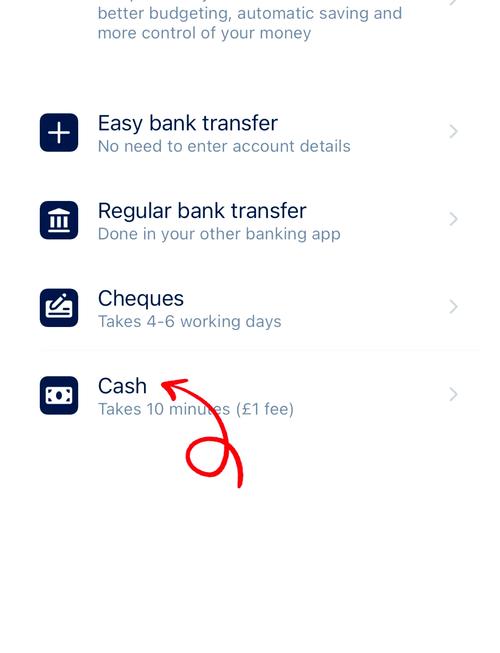

Open the Cash App and navigate to the “Invest” tab.

-

Tap on the stock you want to set a stop-loss order for.

-

Select “Edit” and then “Set Stop-Loss.” Enter the price at which you want to sell the stock.

4. Take Advantage of Dividends

Dividends are payments made by a company to its shareholders, typically in the form of cash. Investing in dividend-paying stocks can be a fast way to make money on Cash App, as you’ll receive regular income from your investments.

Here’s how to find and invest in dividend-paying stocks on Cash App:

-

Use the search function in the Cash App to look for dividend-paying stocks.

-

Review the stock’s dividend yield, which represents the percentage of the stock’s price that is paid out as dividends.

-

Consider the company’s dividend history and stability.

5. Keep an Eye on Market Trends

Staying informed about market trends and economic indicators can help you identify opportunities to make money on Cash App stocks. By keeping an eye on these factors, you can adjust your investments accordingly.

Here are some market trends and economic indicators to watch:

-

Interest rates and monetary policy decisions by central banks.

-

Political events and elections