As a Cash App customer, you’ve likely experienced a seamless and convenient way to manage your finances. But have you ever wondered what makes Cash App stand out from other payment platforms? Let’s dive into a detailed exploration of what Cash App offers and how it can enhance your financial life.

Understanding Cash App

Cash App, originally known as Square Cash, is a mobile payment service developed by Square, Inc. Since its launch in 2013, it has become a popular choice for peer-to-peer (P2P) transfers, allowing users to send and receive money quickly and easily. Here’s a quick overview of what Cash App is all about:

| Feature | Description |

|---|---|

| Point-of-Sale (POS) Payments | Cash App allows businesses to accept payments from customers using their smartphones or tablets. |

| Direct Deposits | Users can receive their paychecks directly into their Cash App account. |

| Cash Card | A Visa debit card that can be used for purchases, cash withdrawals, and ATM access. |

| Investing | Cash App offers users the ability to invest in stocks, ETFs, and Bitcoin. |

| Deals and Discounts | Cash App users can enjoy discounts and deals at various merchants. |

Key Features of Cash App

Now that you have a basic understanding of Cash App, let’s explore some of its key features in more detail:

1. P2P Transfers

One of the primary uses of Cash App is for P2P transfers. Whether you need to send money to a friend, pay a bill, or split expenses with a group, Cash App makes it easy to transfer funds instantly. Simply enter the recipient’s phone number, email address, or Cashtag, and the money will be sent in real-time.

2. Direct Deposits

With Cash App, you can receive your paychecks directly into your account. This feature is particularly useful for freelancers, gig economy workers, and anyone who wants to avoid waiting for their paycheck to clear.

3. Cash Card

The Cash Card is a Visa debit card that can be used for purchases, cash withdrawals, and ATM access. You can customize the card with your favorite image and even set spending limits. The Cash Card is accepted at millions of locations worldwide, making it a convenient way to manage your finances.

4. Investing

Cash App offers users the ability to invest in stocks, ETFs, and Bitcoin. This feature is particularly appealing to those who want to grow their money while managing their finances through a single platform.

5. Deals and Discounts

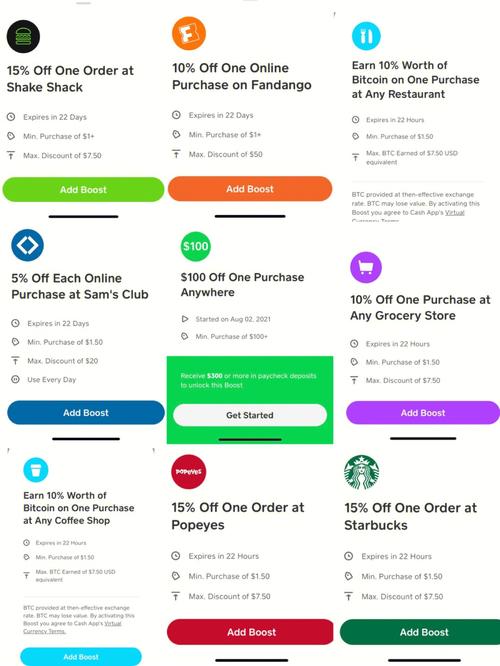

Cash App users can enjoy discounts and deals at various merchants. The Cash Boost feature allows you to round up your purchases and invest the difference in stocks, ETFs, or Bitcoin. This is a great way to save money while investing in your financial future.

Is Cash App Right for You?

Now that you know what Cash App offers, you might be wondering if it’s the right payment platform for you. Here are some factors to consider:

1. Convenience

Cash App is incredibly convenient, with features that make managing your finances a breeze. If you’re looking for a platform that offers a seamless experience, Cash App might be the perfect choice.

2. Cost

Cash App is free to use, with no monthly fees or hidden charges. However, there are some transaction fees to consider, such as a 3% fee for using a credit card to send money.

3. Security

Cash App takes security seriously, offering features like two-factor authentication and fraud protection. However, it’s important to keep your account information secure and be aware of potential scams.

4. Features

Cash App offers a wide range of features, from P2P transfers to investing. If you’re looking for a platform that can help you manage all aspects of your finances, Cash App might be the right choice.