Does Cash App Give You a Virtual Card?

Cash App, a popular mobile payment service, offers a variety of features to its users. One of the most frequently asked questions is whether Cash App provides a virtual card. In this detailed guide, we will explore the various aspects of Cash App’s virtual card feature, including its benefits, how to obtain one, and how to use it effectively.

What is a Virtual Card?

A virtual card is a digital representation of a physical credit or debit card. It is generated online and can be used for online transactions, bill payments, and other digital purchases. Unlike physical cards, virtual cards do not have a physical card number, expiration date, or CVV code, making them more secure for online transactions.

Does Cash App Offer a Virtual Card?

Yes, Cash App offers a virtual card to its users. This feature is available for both Cash App users in the United States and the United Kingdom. The virtual card is generated within the Cash App itself and can be used for a variety of purposes.

How to Obtain a Virtual Card on Cash App

Obtaining a virtual card on Cash App is a straightforward process. Follow these steps:

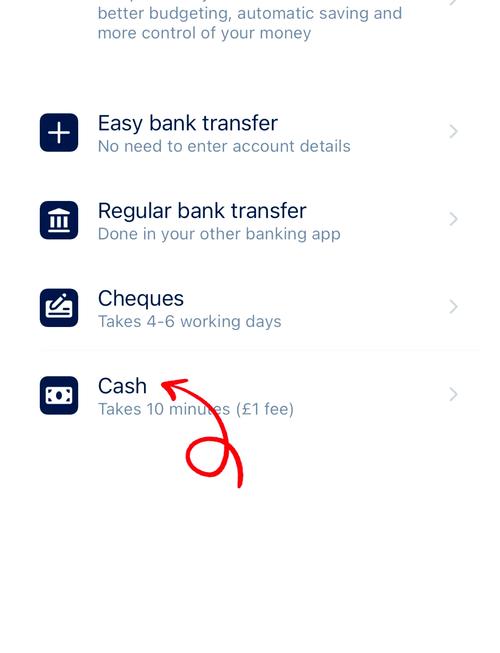

- Open the Cash App on your smartphone.

- Tap on the “Cash & Cards” tab at the bottom of the screen.

- Select “Add Cash Card” and then “Virtual Card” from the options.

- Enter the required details, such as your name and card type (credit or debit).

- Review the terms and conditions, and tap “Create Card” to generate your virtual card.

Once your virtual card is created, you will receive a notification with the card number, expiration date, and CVV code. You can use this information to make online purchases or payments.

Benefits of Using a Cash App Virtual Card

There are several benefits to using a Cash App virtual card:

- Security: Virtual cards are more secure than physical cards, as they do not have a physical card number, expiration date, or CVV code. This reduces the risk of fraud and unauthorized transactions.

- Convenience: Virtual cards can be used for online transactions, bill payments, and other digital purchases without the need for a physical card.

- Control: You can set spending limits and monitor your transactions more easily with a virtual card.

- Privacy: Virtual cards can be used for online purchases without revealing your personal information, such as your name and address.

How to Use Your Cash App Virtual Card

Using your Cash App virtual card is similar to using a physical card. Here’s how to do it:

- Enter the card number, expiration date, and CVV code when prompted during the checkout process.

- Enter your billing address if required.

- Complete the transaction by following the instructions on the screen.

Remember to keep track of your transactions and monitor your Cash App account for any suspicious activity.

Limitations of Cash App Virtual Cards

While Cash App virtual cards offer many benefits, there are some limitations to keep in mind:

- Not Acceptable at ATMs: Virtual cards cannot be used to withdraw cash from ATMs or to make in-person purchases.

- Limited to Online Transactions: Virtual cards are primarily designed for online transactions and may not be accepted at all merchants.

- No Cash Back or Rewards: Virtual cards do not offer cash back or rewards points, as they are not linked to a physical card.

Conclusion

In conclusion, Cash App does offer a virtual card feature to its users. This digital card provides a secure and convenient way to make online purchases and payments. While there are some limitations, the benefits of using a Cash App virtual card make it a valuable tool for many users.