Understanding Cash App: A Comprehensive Guide

Cash App, developed by Square, Inc., has become a popular mobile payment service that offers a variety of financial services. If you’re considering using Cash App, here’s a detailed look at what it is, how it works, and what it offers.

What is Cash App?

Cash App is a mobile payment application that allows users to send, receive, and store money. It was launched in 2013 and has since grown to become a versatile financial platform. The app is available for both iOS and Android devices and is widely used in the United States.

Key Features of Cash App

Here are some of the key features that make Cash App stand out:

| Feature | Description |

|---|---|

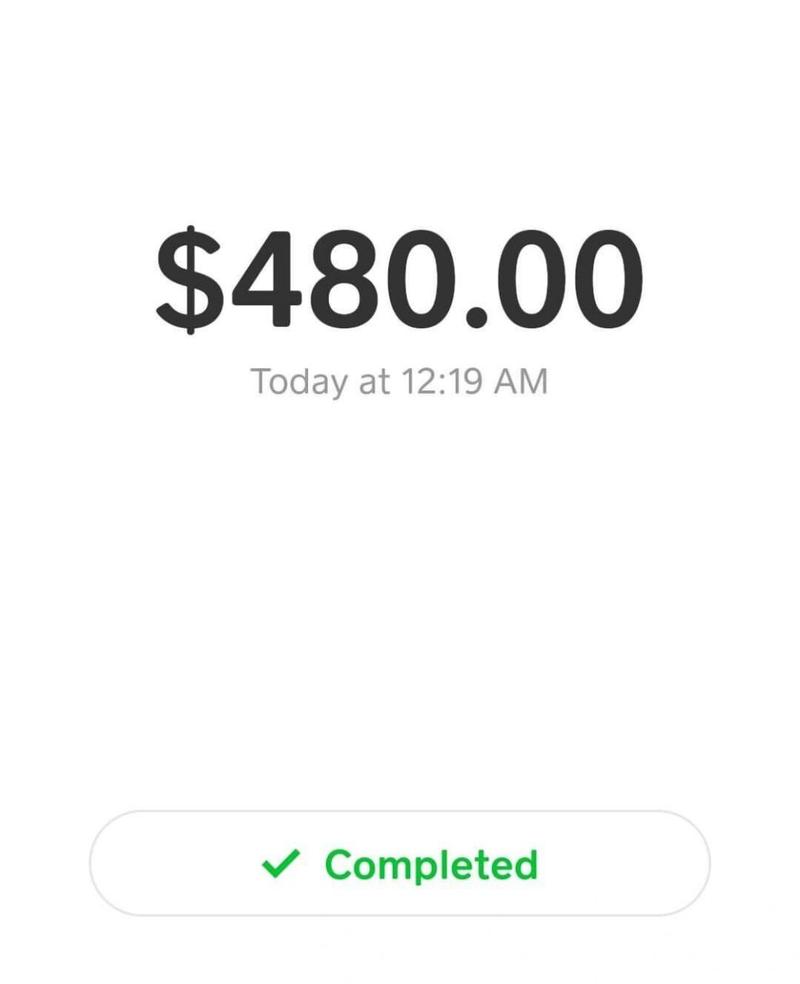

| Peer-to-Peer Transfers | Users can send and receive money from friends and family directly through the app. |

| Direct Deposit | Cash App allows users to receive their paychecks directly into their Cash App account. |

| Cash Card | The Cash Card is a Visa debit card that can be used for purchases and ATM withdrawals. |

| Investing | Cash App offers users the ability to buy and sell stocks, as well as invest in Bitcoin. |

| Cash Boost | Cash Boost is a feature that offers discounts on purchases at various retailers. |

How to Use Cash App

Using Cash App is straightforward. Here’s a step-by-step guide on how to get started:

- Download the Cash App from the App Store or Google Play Store.

- Open the app and enter your phone number to create an account.

- Verify your identity by providing your name, date of birth, and the last four digits of your Social Security number.

- Link a bank account or credit/debit card to your Cash App account.

- Start sending, receiving, and storing money.

Benefits of Using Cash App

There are several benefits to using Cash App:

- Convenience: Cash App allows you to manage your finances on the go, making it easy to send and receive money at any time.

- Security: The app uses advanced encryption to protect your financial information.

- Low Fees: Cash App charges minimal fees for transactions, making it a cost-effective option for managing your finances.

- Investing Opportunities: The ability to invest in stocks and Bitcoin provides users with additional financial opportunities.

Is Cash App Right for You?

Whether Cash App is right for you depends on your financial needs and preferences. Here are some factors to consider:

- Financial Goals: If you’re looking for a convenient way to manage your finances and potentially invest in stocks or Bitcoin, Cash App may be a good fit.

- Transaction Fees: If you’re concerned about transaction fees, be sure to compare Cash App’s fees with those of other payment services.

- Security: Cash App has a strong track record of security, but it’s always important to keep your financial information safe.

Conclusion

Cash App is a versatile financial platform that offers a range of services to help you manage your money. Whether you’re looking for a convenient way to send and receive money, invest in stocks, or simply manage your finances, Cash App may be worth considering.