Understanding Cash App Accounts: A Comprehensive Guide

Cash App accounts have become an integral part of the digital payment ecosystem, offering users a convenient and versatile way to manage their finances. In this detailed guide, we’ll explore the various aspects of Cash App accounts, from their features and benefits to the steps to create and manage them effectively.

What is Cash App?

Cash App is a mobile payment service developed by Square, Inc. Initially launched in 2013 as Square Cash, it has evolved into a comprehensive financial platform. The app allows users to send and receive money, invest in stocks and cryptocurrencies, and even apply for a Cash Card, a free Visa debit card.

Key Features of Cash App Accounts

Here are some of the key features that make Cash App accounts stand out:

| Feature | Description |

|---|---|

| Point-of-Purchase (P2P) Transfers | Send and receive money with friends, family, and colleagues using their phone number, email, or Cashtag. |

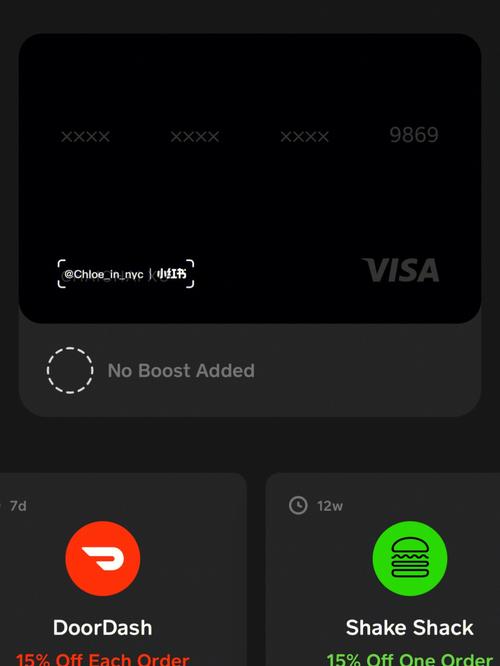

| Cash Card | Receive your pay, direct deposits, and cash out your Cash App balance to your bank account. Use your Cash Card anywhere Visa is accepted. |

| Stocks and Cryptocurrency | Buy and sell stocks, Bitcoin, and Ethereum directly within the app. |

| Cash Boost | Get discounts on purchases when you use your Cash Card. |

| Direct Deposit | Get paid directly to your Cash App account, including your salary, government benefits, and more. |

Creating a Cash App Account

Creating a Cash App account is a straightforward process:

- Download the Cash App from the App Store or Google Play Store.

- Open the app and tap “Sign Up.” Enter your phone number and verify it with a text message.

- Enter your personal information, including your name, date of birth, and Social Security number.

- Link a bank account or a Cash Card to your account.

- Set up a PIN or Touch ID for added security.

Managing Your Cash App Account

Once you have created your Cash App account, here are some tips for managing it effectively:

- Keep track of your transactions by reviewing your activity feed.

- Set up direct deposits to receive your pay and other funds directly into your Cash App account.

- Use the Cash Card for everyday purchases to earn Cash Boost discounts.

- Invest in stocks and cryptocurrencies to grow your wealth.

- Keep your account information up to date to ensure smooth transactions.

Security and Privacy

Cash App takes security and privacy seriously. Here are some of the measures it employs to protect your account:

- Two-factor authentication (2FA) to prevent unauthorized access.

- End-to-end encryption for secure communication.

- Regular security updates to protect against new threats.

Customer Support

Cash App offers customer support through various channels:

- Email: support@cash.app

- Phone: 1-855-235-2825

- Chat: Available within the app

Conclusion

Cash App accounts offer a convenient and versatile way to manage your finances. With its wide range of features, including P2P transfers, Cash Card, stocks and cryptocurrency trading, and direct deposits, Cash App is a valuable tool for anyone looking to simplify their financial life.