Can You Transfer Money from Cash App to Bank Account?

Managing your finances has become easier with the advent of mobile payment apps. One such app is Cash App, which has gained popularity for its user-friendly interface and convenient features. If you’re wondering whether you can transfer money from Cash App to your bank account, you’ve come to the right place. In this detailed guide, we’ll explore the process, fees, and tips to ensure a smooth transfer.

Understanding Cash App

Cash App is a mobile payment service that allows users to send, receive, and request money. It’s developed by Square, a financial services and mobile payment company. The app is available for both iOS and Android devices and offers various features, including the ability to invest in stocks, purchase Bitcoin, and pay bills.

Transferring Money from Cash App to Bank Account

Transferring money from Cash App to your bank account is a straightforward process. Here’s how you can do it:

- Open the Cash App on your smartphone.

- Tap on the “Bank” tab at the bottom of the screen.

- Select “Transfer to Bank” or “Transfer to Card” (if you have a linked credit or debit card).

- Enter the amount you want to transfer.

- Choose your bank from the list of available banks.

- Enter your bank account details, including the routing number and account number.

- Review the transfer details and confirm the transaction.

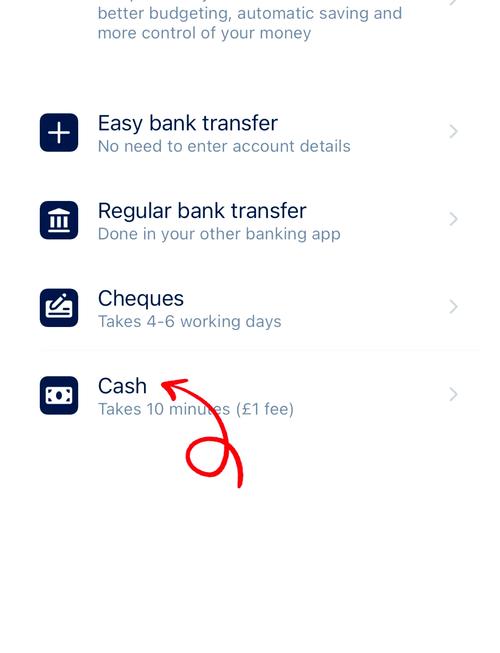

Once you’ve confirmed the transaction, the money will be transferred to your bank account. The transfer time may vary depending on your bank and the type of transfer you choose. Here’s a breakdown of the different transfer options:

| Transfer Type | Transfer Time | Fee |

|---|---|---|

| Instant Transfer | Up to 15 minutes | $1.00 per transfer |

| Standard Transfer | 1-3 business days | Free |

Fees and Limits

When transferring money from Cash App to your bank account, it’s important to be aware of the fees and limits associated with the transaction. Here’s what you need to know:

- Instant Transfer Fees: As mentioned earlier, Instant Transfers cost $1.00 per transaction. This fee is non-refundable and applies to both sending and receiving money.

- Standard Transfer Fees: Standard Transfers are free of charge, but they may take longer to process.

- Bank Account Verification: To transfer money to your bank account, you’ll need to verify your account. This process may require you to provide additional information, such as your bank account number and routing number.

- Transfer Limits: Cash App has daily and weekly transfer limits. The limits may vary depending on your account status and verification level. For example, verified users may have higher limits than unverified users.

Tips for a Successful Transfer

Here are some tips to ensure a smooth and successful transfer from Cash App to your bank account:

- Check Your Bank’s Hours: Make sure your bank is open during the transfer process to avoid delays.

- Double-Check Account Details: Before initiating a transfer, double-check your bank account details to ensure accuracy.

- Keep Track of Your Transactions: Monitor your Cash App account and bank account for any discrepancies or errors.

- Update Your Information: Keep your Cash App account and bank account information up to date to avoid any issues with transfers.

Conclusion

Transferring money from Cash App to your bank account is a convenient and secure way to manage your finances. By following the steps outlined in this guide, you can ensure a smooth and successful transfer. Remember to be aware of the fees and limits associated with the transaction and keep track of your account activity to avoid any issues.