About Cash App Corporation

Cash App Corporation, also known as Square Cash, is a mobile payment service developed by Square, Inc. Since its inception in 2013, Cash App has revolutionized the way people send and receive money. With over 7 million active users as of February 2018, Cash App has become a popular choice for individuals, organizations, and business owners alike.

How Cash App Works

Cash App allows users to send and receive money using their mobile devices. Users can create a unique username to send and receive money, making it easy to transfer funds to friends, family, or businesses. The app supports various payment methods, including bank accounts, credit/debit cards, and Bitcoin. Additionally, Cash App offers a Cash Card, a Visa debit card that can be used for purchases and ATM withdrawals.

Features and Services

Cash App offers a range of features and services to cater to different financial needs:

| Category | Services |

|---|---|

| Banking Services | Point-of-Purchase Transfers, Cash Card, Direct Deposits |

| Investing | Bitcoin Transactions, Stock Trading |

| Spending and Taxes | Cash Boost Discounts, Tax Reporting |

| Merchant Services | Accepting Payments from Consumers |

Bitcoin and Stock Trading

Cash App has gained popularity for its Bitcoin and stock trading features. Users can buy, sell, and trade Bitcoin directly within the app. Additionally, Cash App offers a stock trading platform that allows users to buy and sell shares of various companies. This unique combination of financial services sets Cash App apart from other payment apps.

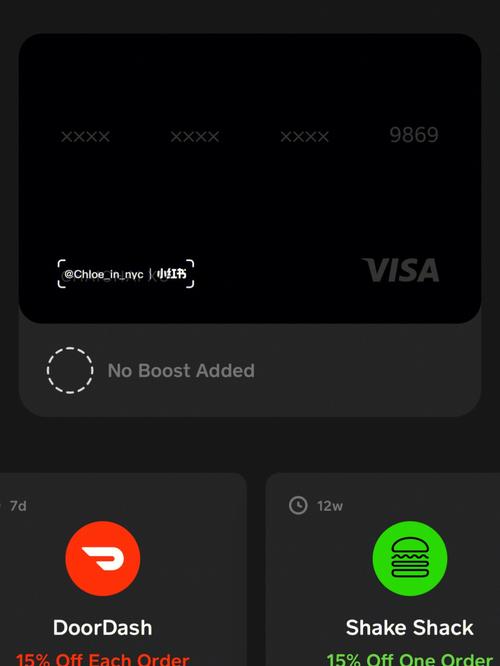

Cash Card and Direct Deposits

The Cash Card is a Visa debit card that can be linked to a user’s Cash App account. Users can use the Cash Card for purchases and ATM withdrawals. Moreover, Cash App supports direct deposits, allowing users to receive their paychecks directly into their Cash App account.

Cash Boost and Tax Reporting

Cash App offers Cash Boost, a feature that provides discounts on purchases made with the Cash Card. Users can also use Cash App to file their taxes, making the process more convenient and straightforward.

Merchant Services

Cash App provides merchant services that allow businesses to accept payments from consumers. This feature is particularly beneficial for small businesses looking to streamline their payment processes and reduce transaction fees.

Market Position and Growth

Cash App has grown significantly since its launch in 2013. As of 2022, the app has over 50 million active users and generates an annual revenue of approximately $10.63 billion. In 2018, Cash App surpassed Venmo in total downloads, becoming the most popular P2P payment platform. Pew Research Center’s study in July 2022 revealed that 26% of American adults use Cash App, making it the fourth most popular payment method after PayPal, Venmo, and Zelle.

Challenges and Future Outlook

Despite its success, Cash App faces challenges in the competitive mobile payment market. The company has been criticized for its high fees and lack of customer support. However, Cash App continues to innovate and expand its services, aiming to become a comprehensive financial platform. In recent years, Cash App has shifted its focus to Bitcoin and other cryptocurrency-related services, reflecting the growing interest in digital currencies.

As the financial landscape evolves, Cash App Corporation remains committed to providing users with convenient and secure payment solutions. With its diverse range of features and services, Cash App is poised to continue its growth and solidify its position as a leading mobile payment provider.