Cash App for Business: A Comprehensive Guide

Cash App for Business is a powerful tool designed to streamline financial operations for small to medium-sized businesses. Whether you’re managing cash flow, sending invoices, or accepting payments, Cash App for Business offers a range of features to help you stay on top of your finances. In this detailed guide, we’ll explore the various aspects of Cash App for Business, including its key features, benefits, and how to get started.

Key Features of Cash App for Business

1. Accepting Payments

Cash App for Business allows you to accept payments from customers quickly and securely. With the Cash App card, you can swipe, insert, or tap to process payments. Additionally, you can use the Cash App QR code to accept payments directly from your customers’ phones.

2. Sending Invoices

Managing invoices can be a time-consuming task, but Cash App for Business simplifies the process. You can create and send professional invoices directly from the app, track payment status, and even set up automatic reminders for late payments.

3. Direct Deposits

With Cash App for Business, you can set up direct deposits to your bank account. This feature ensures that your funds are available when you need them, reducing the need for cash or checks.

4. Expense Tracking

Keeping track of business expenses is crucial for accurate accounting and tax preparation. Cash App for Business allows you to categorize and record expenses, making it easier to manage your finances and stay compliant with tax regulations.

5. Splitting Payments

When you need to split payments with others, Cash App for Business makes it easy. You can divide the payment among multiple recipients, ensuring that everyone gets their fair share.

Benefits of Using Cash App for Business

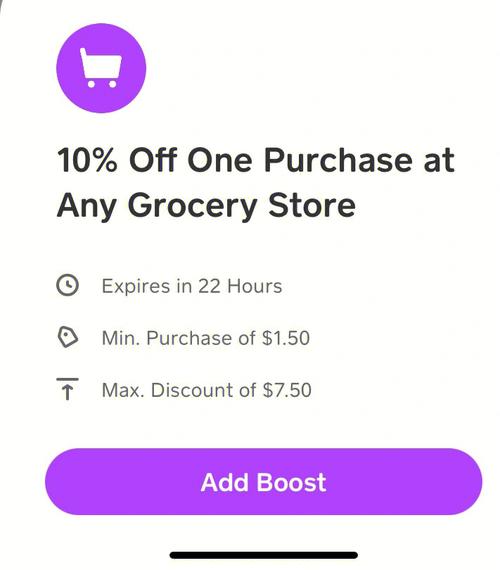

1. Cost-Effective

Cash App for Business offers a free basic plan, making it an affordable option for small businesses. Additionally, the app’s low transaction fees ensure that you keep more of your hard-earned money.

2. User-Friendly Interface

The Cash App for Business interface is intuitive and easy to navigate, even for those who are not tech-savvy. This makes it a great choice for businesses of all sizes.

3. Security

Security is a top priority for Cash App for Business. The app uses advanced encryption and fraud detection tools to protect your financial information and prevent unauthorized access.

4. Integration with Other Tools

Cash App for Business integrates with various other tools and services, such as QuickBooks and PayPal, making it easier to manage your finances and streamline your business operations.

How to Get Started with Cash App for Business

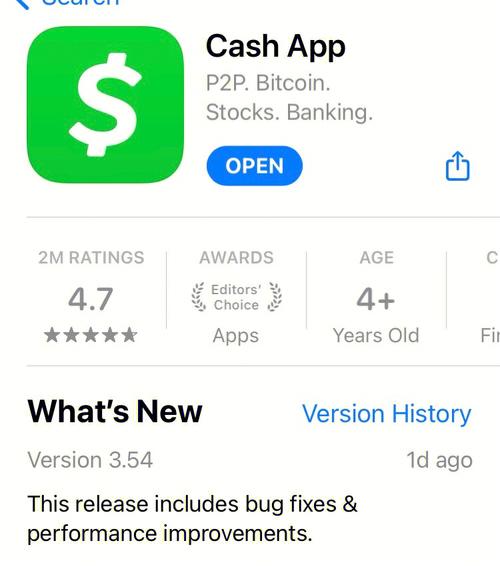

1. Download the App

The first step to getting started with Cash App for Business is to download the app from the App Store or Google Play Store.

2. Create an Account

Once you’ve downloaded the app, create a new account by entering your email address, phone number, and other required information.

3. Link Your Bank Account

Next, link your bank account to the Cash App for Business. This will allow you to receive direct deposits and make payments.

4. Set Up Your Business Profile

Complete your business profile by providing information about your business, such as your business name, address, and tax ID.

5. Start Using the App

Now that you’ve set up your Cash App for Business account, you can start using the app to manage your finances, accept payments, and more.

Conclusion

Cash App for Business is a versatile and user-friendly tool that can help small to medium-sized businesses manage their finances more efficiently. With its wide range of features and benefits, Cash App for Business is an excellent choice for businesses looking to streamline their financial operations.