Cash App Pay in 4: A Comprehensive Guide

Cash App Pay in 4 is a feature that has been making waves in the world of mobile payments. It allows users to split their purchases into four interest-free payments, making it easier to manage larger expenses. If you’re considering using this service, here’s everything you need to know about Cash App Pay in 4.

How Does Cash App Pay in 4 Work?

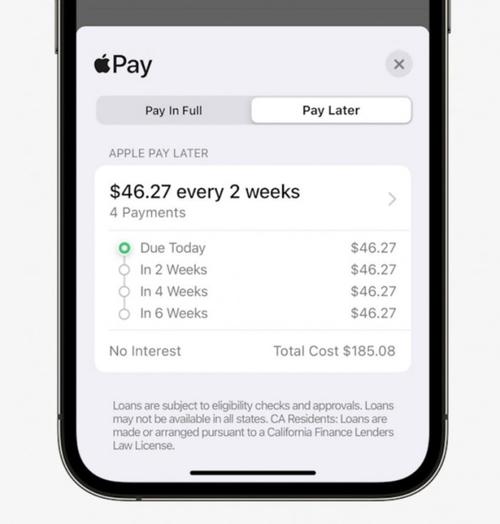

Cash App Pay in 4 is a simple and straightforward process. When you make a purchase using Cash App, you’ll have the option to split the payment into four interest-free installments. This feature is available for eligible purchases and is subject to Cash App’s terms and conditions.

Here’s a step-by-step guide on how to use Cash App Pay in 4:

- Make a purchase using Cash App.

- At checkout, select the “Pay in 4” option.

- Enter your payment information and confirm the transaction.

- Cash App will automatically split the payment into four equal installments.

- You’ll receive reminders before each payment is due.

Eligibility and Fees

Not all purchases are eligible for Cash App Pay in 4. Here are some key factors to consider:

- Eligible Purchases: Cash App Pay in 4 is available for most purchases made through the Cash App, including online and in-store transactions.

- Minimum Purchase Amount: There is a minimum purchase amount required to use Cash App Pay in 4, which varies depending on the merchant.

- Maximum Purchase Amount: There is also a maximum purchase amount, which is typically higher than the minimum.

- Merchant Participation: Not all merchants participate in Cash App Pay in 4. Check with the merchant before making a purchase to ensure they offer this service.

It’s important to note that Cash App Pay in 4 does not charge interest on the installments. However, there may be a small fee associated with the service, which is typically around 3% of the total purchase amount. This fee is disclosed to you before you agree to use Cash App Pay in 4.

Benefits of Using Cash App Pay in 4

Cash App Pay in 4 offers several benefits, making it an attractive option for managing larger expenses:

- Interest-Free Payments: By splitting your purchase into four interest-free installments, you can avoid the burden of high-interest rates.

- Flexibility: Cash App Pay in 4 allows you to manage your finances more effectively by spreading out your payments over time.

- Convenience: The process is simple and straightforward, making it easy to use for both online and in-store purchases.

- Security: Cash App uses advanced security measures to protect your payment information and ensure a safe transaction.

How to Set Up Cash App Pay in 4

Setting up Cash App Pay in 4 is a quick and easy process. Here’s what you need to do:

- Download the Cash App on your smartphone.

- Open the app and sign up for an account.

- Link your bank account or credit/debit card to your Cash App account.

- Make a purchase using Cash App and select the “Pay in 4” option at checkout.

Alternatives to Cash App Pay in 4

While Cash App Pay in 4 is a convenient option, there are other services that offer similar features:

- Afterpay: Afterpay allows users to split their purchases into four interest-free installments, with the first payment due two weeks after the purchase.

- Sezzle: Sezzle offers interest-free financing for purchases, with payments spread over four weeks.

- Splitit: Splitit allows users to split their purchases into up to 24 interest-free installments.

Each of these services has its own set of terms and conditions, so it’s important to compare them before choosing the one that best suits your needs.

Conclusion

C