Understanding Cash App: A Comprehensive Guide

Cash App is a versatile mobile payment service that has gained significant popularity in recent years. Whether you’re looking to send money, invest in stocks, or simply manage your finances, Cash App offers a range of features that cater to your needs. In this detailed guide, we’ll explore the various aspects of Cash App, from its registration process to its unique features and benefits.

How to Register for Cash App

Registering for Cash App is a straightforward process. Simply download the app from the App Store or Google Play Store, and follow these steps:

- Open the app and tap “Sign Up.”

- Enter your phone number and email address.

- Verify your phone number by entering the code sent to your phone.

- Set up a password for your account.

- Link your bank account or credit/debit card to fund your Cash App balance.

Once your account is set up, you can start using Cash App’s various features, such as sending and receiving money, paying bills, and investing in stocks.

Key Features of Cash App

Cash App offers a variety of features that make it a convenient and versatile payment service. Here are some of the most notable features:

- Send and Receive Money: You can easily send and receive money from friends, family, and businesses using Cash App. Simply enter the recipient’s phone number, email address, or $Cashtag.

- Cash Out: Transfer funds from your Cash App balance to your linked bank account or debit card. This feature is available for a small fee.

- Cash Card: The Cash Card is a Visa debit card that you can use to make purchases online, in-store, or at ATMs. You can even customize the card with your favorite image.

- Stock Investing: Cash App allows you to buy and sell stocks, ETFs, and Bitcoin directly from the app. This feature is available to users aged 18 and older.

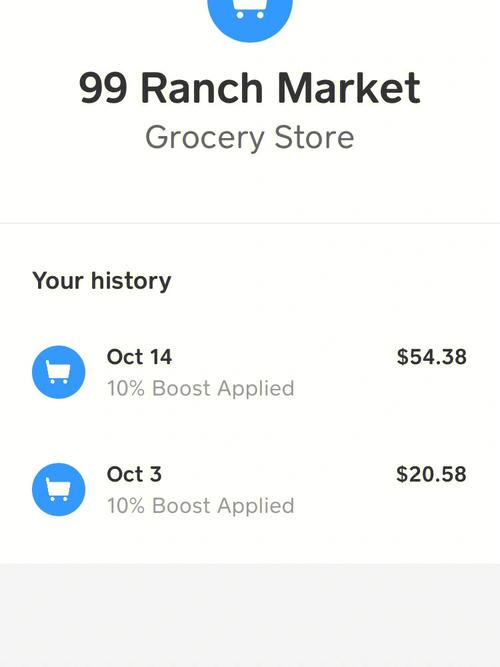

- Deals and Boosts: Take advantage of Cash App’s deals and boosts to save money on purchases. For example, you can get discounts on popular products or services by using Cash App to pay.

- Free Tax Filing: Cash App offers free tax filing services for users who have earned income through the app.

How to Use Cash App for Stock Investing

Cash App’s stock investing feature is a great way to get started in the stock market. Here’s how to use it:

- Tap the “Invest” tab in the app.

- Choose the stock, ETF, or Bitcoin you want to invest in.

- Enter the amount you want to invest.

- Confirm your investment and watch your portfolio grow.

It’s important to note that investing in stocks involves risk, and you should only invest money that you can afford to lose.

Is Cash App Safe to Use?

Cash App takes security seriously and offers several features to protect your account:

- Two-Factor Authentication: Enable two-factor authentication to add an extra layer of security to your account.

- Biometric Authentication: Use Touch ID or Face ID to log in to the app.

- 24/7 Monitoring: Cash App monitors your account for suspicious activity and alerts you if any issues are detected.

However, it’s always important to keep your account information secure and be cautious when sharing it with others.

Which Banks Are Supported by Cash App?

Cash App supports a wide range of banks, making it easy to link your account and start using the app. Here’s a list of some of the supported banks:

| Bank | Supported |

|---|---|

| Chase | Yes |

| Bank of America | Yes |

| Citibank

|