Cash App Monthly Payment: A Comprehensive Guide

Managing your finances can be a daunting task, especially when it comes to paying bills on time. Cash App, a popular mobile payment service, offers a convenient way to make monthly payments. In this article, we will delve into the various aspects of Cash App monthly payments, including how to set them up, the fees involved, and the benefits of using this service.

How to Set Up Monthly Payments on Cash App

Setting up monthly payments on Cash App is a straightforward process. Here’s a step-by-step guide to help you get started:

- Open the Cash App on your smartphone.

- Tap on the “Pay or Send” button at the bottom of the screen.

- Enter the email address or phone number of the person or business you want to pay.

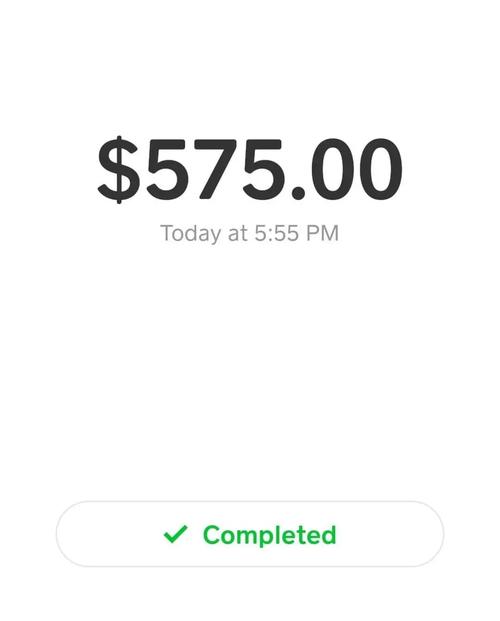

- Enter the amount you wish to pay.

- Select “Schedule Payment” from the dropdown menu.

- Choose the date you want the payment to be processed.

- Review the payment details and confirm the transaction.

Once you’ve set up your monthly payment, you can rest assured that your bills will be paid on time, every time.

Fees Associated with Cash App Monthly Payments

While Cash App offers a convenient way to manage your monthly payments, it’s important to be aware of the fees associated with the service. Here’s a breakdown of the fees you may encounter:

| Transaction Type | Fee |

|---|---|

| Domestic Debit Card Transactions | Free |

| Domestic Credit Card Transactions | 3% of the transaction amount |

| International Transactions | 3% of the transaction amount |

| ACH Bank Transfers | Free |

| Instant Bank Transfers | $1.50 per transaction |

It’s important to note that Cash App does not charge any fees for setting up or scheduling monthly payments. However, the fees associated with the payment method you choose may apply.

Benefits of Using Cash App for Monthly Payments

Using Cash App for your monthly payments offers several benefits, including:

- Convenience: With Cash App, you can make payments from anywhere, at any time, using your smartphone.

- Security: Cash App uses advanced encryption technology to protect your financial information.

- Speed: Payments are processed quickly, ensuring that your bills are paid on time.

- Customizable Alerts: You can set up customizable alerts to remind you when your monthly payments are due.

- Multiple Payment Options: Cash App supports various payment methods, including debit cards, credit cards, and bank transfers.

Additionally, Cash App offers a “Payday Loan” feature, which allows you to borrow money against your expected paycheck. This can be particularly helpful if you need to cover an unexpected expense before your next payment.

How to Cancel a Monthly Payment on Cash App

Occasionally, you may need to cancel a scheduled monthly payment on Cash App. Here’s how to do it:

- Open the Cash App on your smartphone.

- Tap on the “Activity” tab at the bottom of the screen.

- Find the payment you want to cancel.

- Tap on the payment to view the details.

- Tap on the “Cancel Payment” button.

- Confirm the cancellation.

It’s important to note that you can only cancel a payment if it has not yet been processed. Once the payment has been processed, you will need to contact the person or business you paid to request a refund.

Conclusion

Cash App monthly payments offer a convenient, secure, and efficient way to manage your finances.