Understanding Cash Card and Cash App: A Comprehensive Guide

Cash Card and Cash App have revolutionized the way we manage our finances and make transactions. In this detailed guide, we’ll explore what these services are, how they work, and the benefits they offer. Whether you’re new to the world of digital banking or looking to enhance your financial management skills, this article will provide you with all the information you need.

What is Cash Card?

The Cash Card is a Visa debit card issued by Square, the company behind Cash App. It’s designed to be a convenient and secure way to access your funds and make purchases. Here’s a breakdown of its key features:

-

Instant access to your Cash App balance

-

Acceptable at millions of locations worldwide

-

Customizable card design

-

Support for Apple Pay and Google Pay

What is Cash App?

Cash App is a mobile payment service developed by Square. It allows users to send, receive, and spend money using their smartphones. Here’s an overview of its main features:

-

Point-of-person (P2P) transfers

-

Bitcoin and stock trading

-

Cash Card

-

Direct deposits

-

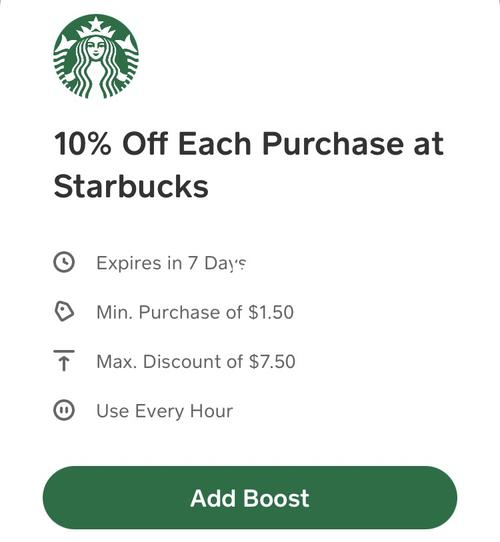

Cash Boost discounts

-

Tax preparation

-

Payment services for merchants

How to Get Started with Cash Card and Cash App

Getting started with Cash Card and Cash App is a straightforward process. Here’s a step-by-step guide:

-

Download the Cash App from the App Store or Google Play Store

-

Open the app and sign up for an account

-

Link your bank account or credit/debit card to the app

-

Order your Cash Card

-

Activate your Cash Card

Benefits of Using Cash Card and Cash App

There are several benefits to using Cash Card and Cash App:

-

Convenience: Access your funds and make transactions anytime, anywhere

-

Security: Your account is protected by multiple layers of security, including two-factor authentication

-

Transparency: All transactions are recorded in the app, making it easy to track your spending

-

Flexibility: Use your Cash Card and Cash App for a variety of transactions, from P2P transfers to stock trading

Understanding the Fees

It’s important to be aware of the fees associated with Cash Card and Cash App. Here’s a breakdown of the most common fees:

| Transaction Type | Fee |

|---|---|

| Point-of-Person (P2P) Transfers | $1.50 per transaction |

| Bitcoin Transactions | Varies depending on the transaction amount and network fees |

| Stock Transactions | $1.00 per trade |

| Cash Card ATM Withdrawals | $2.50 per withdrawal |

| Cash Card Replacement | $5.00 |

Customer Support

Cash App offers customer support through various channels, including email, phone, and chat. You can also find answers to common questions in the app’s help center.

Conclusion

Cash Card and Cash App are powerful tools that can help you manage your finances and make transactions more efficiently. By understanding their features, benefits, and fees, you can make informed decisions about how to use these