Understanding the Issue: Sending Money to a Closed Cash App Account

Have you ever found yourself in a situation where you sent money to a closed Cash App account? It’s a common issue that many users encounter, and it can be quite frustrating. In this article, we will delve into the details of this problem, exploring the reasons behind it, the potential consequences, and the steps you can take to resolve it.

What Happens When You Send Money to a Closed Cash App Account?

When you attempt to send money to a closed Cash App account, the transaction is typically declined. The Cash App will notify you that the recipient’s account is closed and that the payment cannot be processed. However, the money you sent may still be in limbo, pending further action from both parties involved.

Reasons for a Closed Cash App Account

There are several reasons why a Cash App account might be closed. Some of the most common reasons include:

| Reason | Description |

|---|---|

| Violation of Terms of Service | Account closure due to violations such as fraud, money laundering, or other illegal activities. |

| Inactivity | Account closure due to prolonged inactivity, as per Cash App’s terms and conditions. |

| Account Merge | Account closure as part of a merge with another Cash App account. |

| Account Closure Request | User-initiated closure of the account. |

Consequences of Sending Money to a Closed Cash App Account

Sending money to a closed Cash App account can have several consequences, including:

-

Financial Loss: If the recipient’s account is closed, you may not receive a refund for the money you sent.

-

Account Restrictions: In some cases, Cash App may place restrictions on your account, such as limiting the amount of money you can send or receive.

-

Security Risks: If the closed account was involved in fraudulent activities, you may be at risk of identity theft or other security breaches.

Steps to Resolve the Issue

Here are some steps you can take to resolve the issue of sending money to a closed Cash App account:

-

Contact the Recipient: Reach out to the recipient to inform them about the situation and ask if they can provide any assistance.

-

Check Your Account: Review your Cash App account for any restrictions or limitations that may have been imposed.

-

File a Dispute: If you believe the transaction was made in error, you can file a dispute with Cash App to request a refund.

-

Monitor Your Account: Keep an eye on your Cash App account for any suspicious activity or unauthorized transactions.

Preventing Future Issues

Here are some tips to help you avoid sending money to a closed Cash App account in the future:

-

Verify Recipient’s Account Status: Before sending money, ensure that the recipient’s Cash App account is active and in good standing.

-

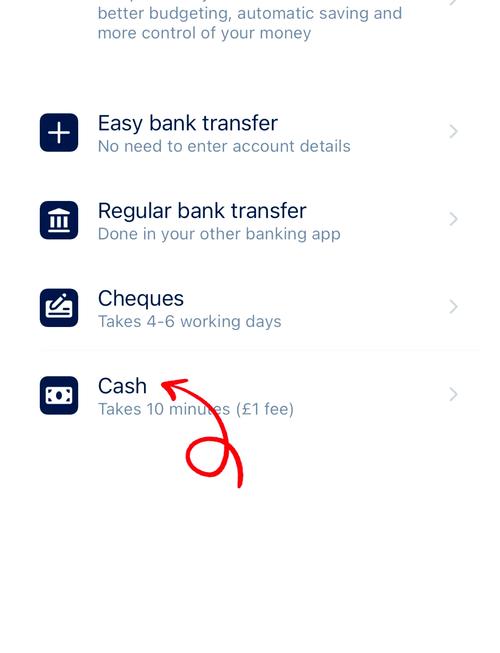

Use Secure Payment Methods: Consider using other payment methods, such as credit cards or bank transfers, for transactions that involve higher amounts or unfamiliar recipients.

-

Stay Informed: Keep up-to-date with Cash App’s terms and conditions to understand the risks and consequences of sending money to closed accounts.

In conclusion, sending money to a closed Cash App account can be a frustrating experience, but it’s important to remain calm and take appropriate steps to resolve the issue. By understanding the reasons behind account closures, the potential consequences, and the steps to resolve the problem, you can minimize the risk of financial loss and protect your account from future issues.