Understanding Free Cash Bank Transfer: A Comprehensive Guide

Free cash bank transfer has become an integral part of modern banking, offering individuals and businesses a convenient and efficient way to manage their finances. In this article, we will delve into the details of free cash bank transfer, exploring its benefits, how it works, and the various aspects you need to consider before making a transfer.

What is Free Cash Bank Transfer?

Free cash bank transfer refers to the process of transferring money from one bank account to another without incurring any fees. This service is typically offered by banks as a way to encourage customers to use their services and to promote financial inclusion. It is important to note that while the transfer itself is free, certain conditions may apply, such as a minimum balance requirement or a maximum transfer limit.

Benefits of Free Cash Bank Transfer

There are several benefits to using free cash bank transfer:

-

Convenience: Free cash bank transfer allows you to send and receive money quickly and easily, without the need to visit a physical branch.

-

Cost-effective: As the name suggests, this service is free, which means you can save money on transfer fees.

-

Security: Most banks offer secure transfer options, such as two-factor authentication, to protect your account from unauthorized access.

-

Accessibility: Free cash bank transfer is available to most customers, regardless of their income or financial status.

How Free Cash Bank Transfer Works

Here’s a step-by-step guide on how to make a free cash bank transfer:

-

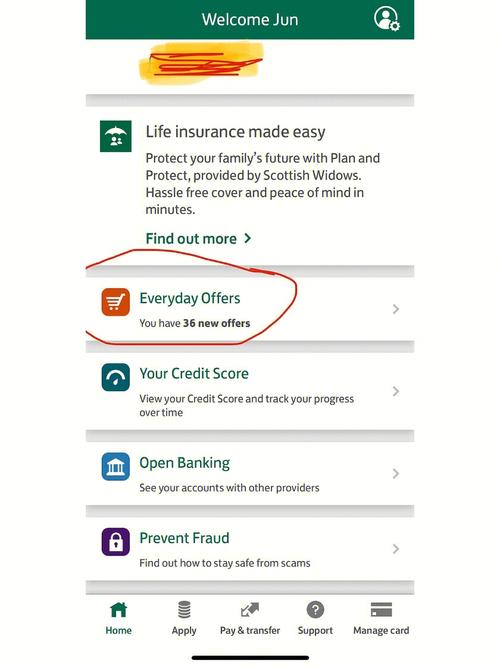

Log in to your online banking account.

-

Select the “Transfer” or “Pay” option.

-

Enter the recipient’s account details, including their name, account number, and bank name.

-

Enter the amount you wish to transfer.

-

Review the transaction details and confirm the transfer.

-

Wait for the transfer to be processed, which typically takes a few minutes to a few hours, depending on the bank and the time of day.

Types of Free Cash Bank Transfers

There are several types of free cash bank transfers, each with its own set of features and benefits:

-

Instant transfers: These transfers are processed almost instantly, allowing you to send and receive money in real-time.

-

Same-day transfers: These transfers are processed on the same day, but may take a few hours to complete.

-

Next-day transfers: These transfers are processed the next business day, typically by the end of the day.

-

Standard transfers: These transfers may take several days to complete, depending on the bank and the destination country.

Considerations Before Making a Free Cash Bank Transfer

Before making a free cash bank transfer, there are several factors to consider:

-

Recipient’s bank: Ensure that the recipient’s bank supports free cash bank transfers.

-

Transfer limits: Check the maximum transfer limit for your account, as this may vary depending on the bank and the type of transfer.

-

Transfer fees: While the transfer itself is free, there may be other fees associated with the transaction, such as foreign exchange fees or third-party service fees.

-

Transaction time: Consider the time it takes to process the transfer, as this may affect the availability of funds for the recipient.

Table: Free Cash Bank Transfer Fees

| Bank | Instant Transfer Fee | Same-day Transfer Fee | Next-day Transfer Fee | Standard Transfer Fee |

|---|---|---|---|---|

| Bank A | $0 | $5 | $3 | $2 |

| Bank B

|