Understanding Cash App and Zelle: A Comprehensive Guide

Cash App and Zelle have become popular payment methods in the United States, offering users a convenient way to send and receive money. Whether you’re a frequent user or new to these platforms, it’s essential to understand how they work and their features. Let’s dive into a detailed comparison of Cash App and Zelle, covering various aspects such as fees, security, and usage scenarios.

What is Cash App?

Cash App is a mobile payment service developed by Square, Inc. It allows users to send, receive, and store money using their smartphones. The app offers various features, including point-of-sale payments, direct deposits, and the ability to purchase stocks and Bitcoin. Here’s a breakdown of its key features:

- Point-of-Sale Payments: Users can make purchases at participating merchants by scanning a QR code or entering their Cash App account number.

- Direct Deposits: Users can receive their paychecks, tax refunds, and other payments directly into their Cash App account.

- Stocks and Bitcoin: Users can buy and sell stocks and Bitcoin directly within the app.

- Cash Card: A Visa debit card that can be used for purchases, cash withdrawals, and ATM access.

- Cash Boost: Offers discounts on purchases made with the Cash Card.

- Free Tax Filing: Users can file their taxes for free using the app.

What is Zelle?

Zelle is a person-to-person (P2P) payment service that allows users to send and receive money quickly and securely. It’s available through most U.S. banks and credit unions. Here are the key features of Zelle:

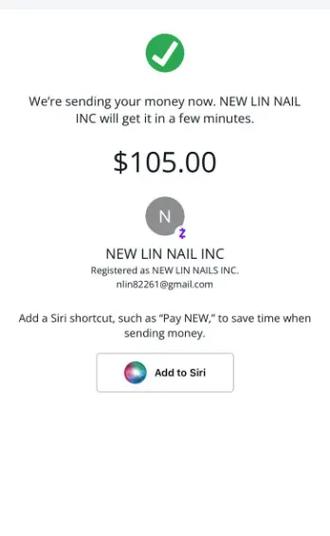

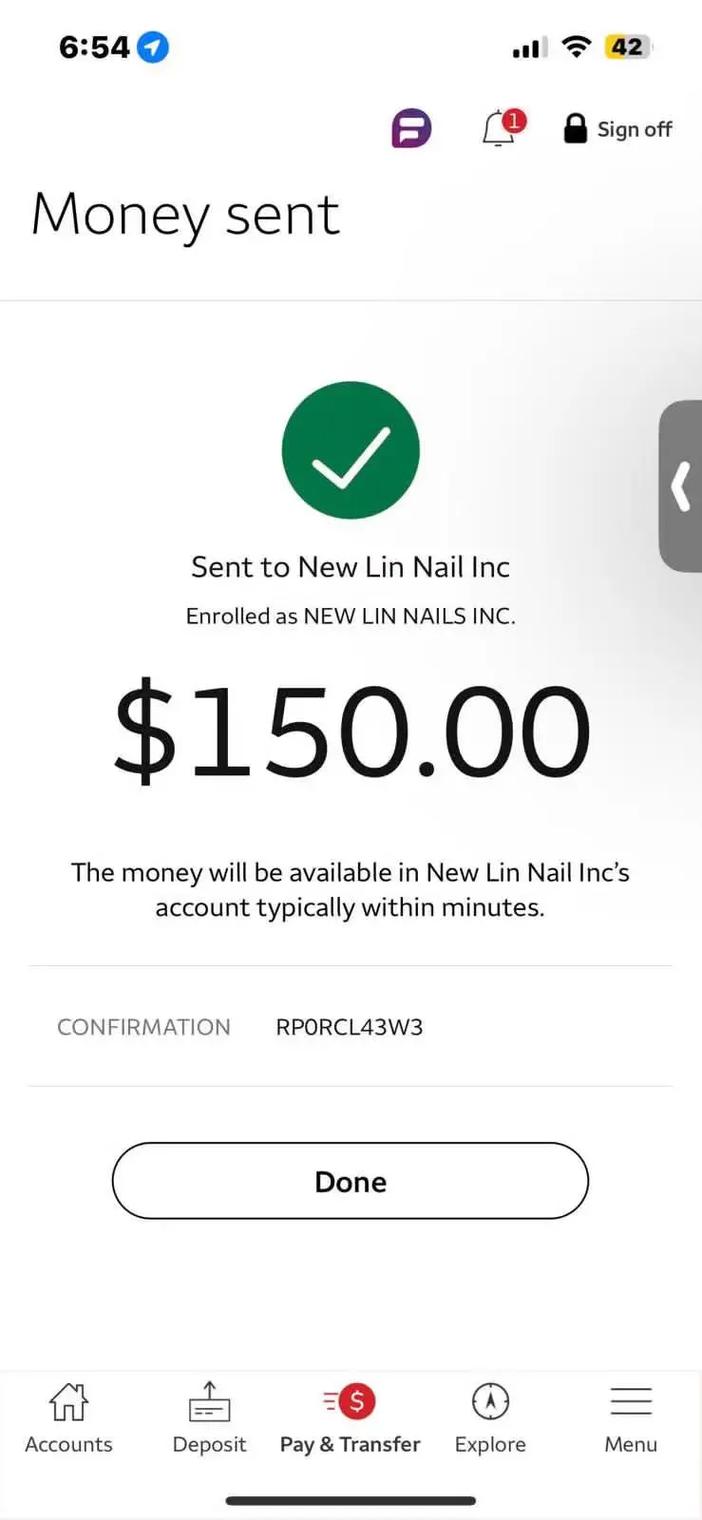

- Quick Transfers: Money is typically available in minutes when sending to a recipient’s bank account.

- Multiple Ways to Send and Receive: Users can send and receive money using their bank account, email address, or phone number.

- No Fees: Zelle does not charge users any fees for sending or receiving money.

Comparison of Cash App and Zelle

Now that we have a basic understanding of both Cash App and Zelle, let’s compare them in various aspects:

Fees

| Feature | Cash App | Zelle |

|---|---|---|

| Point-of-Sale Payments | Varies by merchant | Varies by merchant |

| Direct Deposits | Free | Free |

| Stocks and Bitcoin | Varies by transaction | Not available |

| Cash Card | Free | Not available |

| Free Tax Filing | Free | Not available |

Security

Both Cash App and Zelle prioritize user security. They use encryption to protect users’ personal and financial information. Here are some security features:

- Two-Factor Authentication: Users must provide a second form of verification, such as a text message or biometric authentication, to access their accounts.

- Transaction Notifications: Users receive notifications for every transaction made on their accounts.

- Dispute Resolution: Users can dispute unauthorized transactions and work with the platform to resolve issues.

Usage Scenarios

Here are some scenarios where Cash App and Zelle might be more suitable:

- Cash App:

- When you need to make a point-of-sale payment at a participating merchant.

- When you want to receive your paychecks or tax refunds