Can You Cash a Check in Cash App?

Are you wondering if you can cash a check using Cash App? Well, you’ve come to the right place. In this detailed guide, I’ll walk you through the process, the requirements, and the potential fees involved. Let’s dive in!

Understanding Cash App

Cash App is a mobile payment service that allows users to send and receive money, pay bills, and even invest. It’s a popular choice for its ease of use and the variety of features it offers. One of the most frequently asked questions about Cash App is whether it allows users to cash checks.

Can You Cash a Check in Cash App?

Yes, you can cash a check in Cash App. The service is called “Cash Out” and it allows you to deposit checks directly into your Cash App account. Here’s how it works:

- Open the Cash App on your smartphone.

- Tap on the “Cash Out” button.

- Enter the amount you want to deposit.

- Choose “Check” as the deposit method.

- Take a clear photo of the front and back of your check.

- Review the details and confirm the deposit.

Once your check is approved, the funds will typically be available in your Cash App account within one to three business days.

Requirements for Cashing a Check in Cash App

Before you can cash a check in Cash App, there are a few requirements you need to meet:

- Your Cash App account must be verified. This means you’ll need to provide your full name, date of birth, Social Security number, and a photo of your government-issued ID.

- The check must be made payable to you. Cash App does not allow users to cash checks made out to someone else.

- The check must be dated within the last 6 months.

- The check must be from a U.S. bank.

How to Verify Your Cash App Account

Verifying your Cash App account is a straightforward process:

- Open the Cash App on your smartphone.

- Tap on the “Profile” icon.

- Select “Personal” or “Business” depending on your account type.

- Tap on “Verify” and follow the prompts.

During the verification process, you may be asked to provide additional information, such as your address or a photo of your ID. Once your account is verified, you’ll be able to cash checks and access other features of Cash App.

Understanding Cash Out Fees

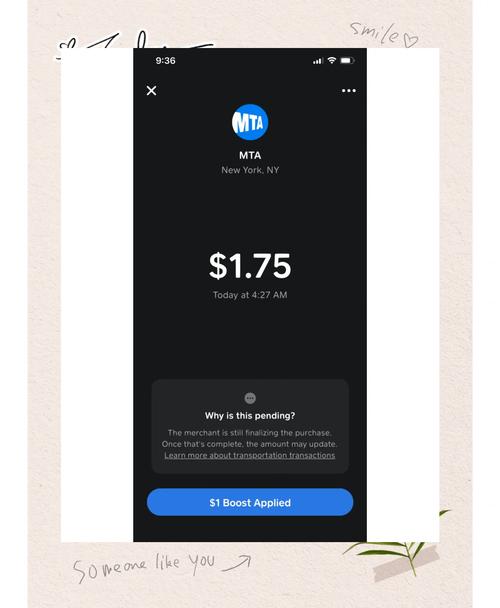

When you cash a check in Cash App, there is a fee associated with the transaction. As of my knowledge cutoff date, the fee is $1.50 for each check. This fee is automatically deducted from the amount you deposit.

Here’s a breakdown of the Cash Out fees:

| Transaction Type | Fee |

|---|---|

| Cash Out with a Debit Card | $1.50 |

| Cash Out with a Bank Account | $1.50 |

| Cash Out with a Cash Card | $1.50 |

It’s important to note that Cash App may also charge additional fees for certain transactions, such as international transfers or cash reloads. Be sure to review the Cash App fee schedule for the most up-to-date information.

Alternatives to Cashing a Check in Cash App

While Cash App offers a convenient way to cash checks, it’s not the only option available. Here are some alternatives to consider:

- Banking Institutions: You can cash a check at your local bank or credit union. Most banks charge a fee for this service, but it may be lower than the fee charged by Cash App.

- Check Cashing Stores: There are numerous check-cashing stores across the country that offer this service. While these stores may charge higher fees, they provide a quick and easy way to cash a