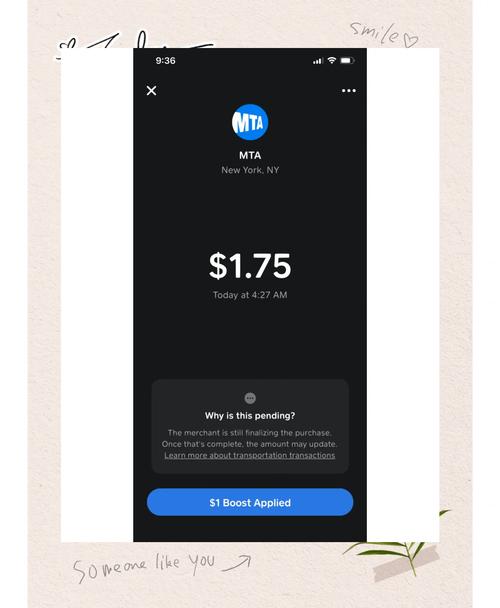

How Do You Borrow on Cash App?

Are you looking to borrow money through the Cash App? If so, you’ve come to the right place. The Cash App is a popular mobile payment service that offers various financial services, including the ability to borrow money. In this detailed guide, we’ll walk you through the process of borrowing on Cash App, from eligibility to repayment options. Let’s dive in!

Understanding the Borrowing Feature

The Cash App’s borrowing feature allows users to borrow money directly from the app. This feature is available to eligible users who meet specific criteria. Before you proceed, it’s essential to understand how the borrowing feature works and its terms and conditions.

When you borrow money on Cash App, you’ll receive a cash advance that you can use for any purpose. The borrowed amount will be deducted from your next direct deposit, and you’ll be charged interest on the borrowed amount. The interest rate and repayment terms may vary depending on your creditworthiness and the amount you borrow.

Eligibility for Borrowing on Cash App

Not everyone is eligible to borrow money on Cash App. To be eligible, you must meet the following criteria:

-

Be at least 18 years old

-

Have a Cash App account

-

Have a verified bank account

-

Have a steady source of income

-

Meet the Cash App’s credit requirements

Keep in mind that the Cash App may also consider other factors when determining your eligibility for borrowing. It’s essential to maintain a good credit score and financial history to increase your chances of being approved.

How to Borrow Money on Cash App

Now that you understand the borrowing feature and eligibility criteria, let’s walk you through the process of borrowing money on Cash App:

-

Open the Cash App on your smartphone

-

Tap on the “Borrow” button located at the bottom of the screen

-

Enter the amount you wish to borrow

-

Review the terms and conditions of the loan, including the interest rate and repayment schedule

-

Tap “Borrow” to submit your request

-

Wait for the Cash App to review your request and determine your eligibility

-

If approved, the borrowed amount will be deposited into your Cash App account

Understanding the Repayment Process

Once you’ve borrowed money on Cash App, it’s crucial to understand the repayment process. Here’s what you need to know:

-

Repayment Schedule: The repayment schedule will be based on your next direct deposit. The borrowed amount, along with the interest, will be deducted from your direct deposit.

-

Interest Rate: The interest rate on your loan will be determined by your creditworthiness and the amount you borrow. The Cash App will provide you with the interest rate before you proceed with the borrowing process.

-

Repayment Options: You can choose to repay the loan in full or make partial payments. However, it’s essential to make timely payments to avoid late fees and negatively impact your credit score.

Benefits and Drawbacks of Borrowing on Cash App

Like any financial product, borrowing money on Cash App has its benefits and drawbacks. Here’s a quick overview:

Benefits

-

Easy access to cash when you need it

-

Flexible repayment options

-

No credit check required

Drawbacks

-

Interest rates may be higher than traditional loans

-

May negatively impact your credit score if you fail to make timely payments

-

Not available in all states

Conclusion

Borrowing money on Cash App can be a convenient way to access cash when you need it. However, it’s essential to understand the terms and conditions