How to Cash Out Your Stocks on Cash App: A Detailed Guide

Investing in stocks can be a lucrative venture, but when it’s time to cash out, you want to ensure the process is smooth and hassle-free. If you’re a user of Cash App, you might be wondering how to cash out your stocks. This guide will walk you through the entire process, from understanding the basics to completing the transaction.

Understanding the Basics of Cashing Out Stocks on Cash App

Cash App allows users to buy and sell stocks, as well as cash out their investments. To cash out your stocks, you need to have a Cash App account and have purchased stocks through the app. Here’s a quick overview of the process:

| Step | Description |

|---|---|

| 1 | Open your Cash App account. |

| 2 | Go to the “Invest” tab. |

| 3 | Select the stock you want to cash out. |

| 4 | Choose the “Sell” option. |

| 5 | Enter the amount you want to sell. |

| 6 | Review the transaction details and confirm. |

Once you’ve completed these steps, your stocks will be sold, and the proceeds will be transferred to your Cash App balance. From there, you can withdraw the funds to your bank account or use them for other transactions within the app.

Before You Begin: Check Your Account Balance

Before you start the cashing out process, it’s essential to check your account balance. This will give you an idea of how much money you’ll have after selling your stocks. To check your balance:

- Open your Cash App account.

- Tap on the “Balance” tab at the bottom of the screen.

- Review your current balance.

Remember that the balance may not reflect the exact amount you’ll receive after selling your stocks, as there may be fees or taxes involved.

Understanding Fees and Taxes

When cashing out your stocks, it’s crucial to understand the fees and taxes that may apply. Here’s a breakdown of the common costs:

| Type of Fee | Description |

|---|---|

| Transaction Fee | A fee charged by Cash App for each stock transaction. |

| Market Fee | A fee charged by the stock exchange where your stocks are traded. |

| Taxes | Capital gains tax may apply if you’ve held the stocks for more than a year. |

It’s essential to research these fees and taxes before cashing out to ensure you’re aware of the total cost of the transaction.

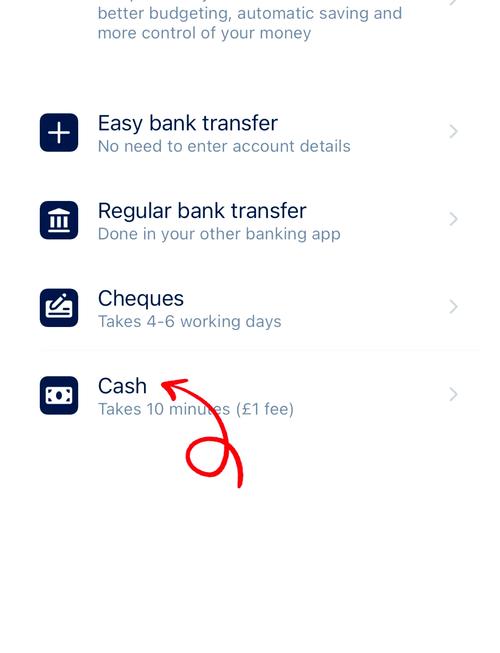

Withdrawing Funds to Your Bank Account

Once you’ve sold your stocks and the proceeds have been transferred to your Cash App balance, you can withdraw the funds to your bank account. Here’s how to do it:

- Open your Cash App account.

- Tap on the “Bank” tab at the bottom of the screen.

- Select “Add Bank Account” if you haven’t already.

- Enter your bank account details and confirm.

- Tap on the “Withdraw” button.

- Enter the amount you want to withdraw.

- Review the transaction details and confirm.

It typically takes 1-3 business days for the funds to be transferred to your bank account. Keep in mind that there may be a limit on the amount you can withdraw in a single transaction.