Cash App Fee to Send Money: A Comprehensive Guide

When it comes to sending money through Cash App, understanding the fees involved is crucial. Whether you’re a frequent user or new to the platform, this detailed guide will help you navigate the fee structure, factors that affect the cost, and how to minimize expenses. Let’s dive in.

Understanding Cash App Fees

Cash App charges a fee for sending money, which is a standard practice for many peer-to-peer payment platforms. The fee is calculated based on a percentage of the transaction amount and is deducted from the total amount sent.

| Transaction Type | Fee Rate |

|---|---|

| Domestic Transactions | 1.5% + $0.25 |

| International Transactions | 3.5% + $0.25 |

As you can see from the table above, domestic transactions are charged a fee of 1.5% plus $0.25, while international transactions incur a higher fee of 3.5% plus $0.25. It’s important to note that these fees are subject to change, so it’s always a good idea to check the latest rates on the Cash App website or within the app.

Factors Affecting the Cost

Several factors can influence the cost of sending money through Cash App. Here are some key considerations:

-

Transaction Amount: The larger the amount you send, the higher the fee will be, as it’s calculated as a percentage of the transaction amount.

-

Transaction Type: As mentioned earlier, domestic transactions are generally cheaper than international transactions.

-

Payment Method: The method you use to fund your Cash App account can also affect the fee. For example, using a credit card may incur additional fees.

-

Recipient’s Country: If you’re sending money to someone in a different country, the transaction will be classified as an international transaction, resulting in higher fees.

How to Minimize Fees

While you can’t avoid fees entirely, there are ways to minimize them:

-

Use a Bank Account: Funding your Cash App account with a bank account is generally the cheapest option, as it avoids additional fees associated with credit cards or other payment methods.

-

Choose Domestic Transactions: Whenever possible, opt for domestic transactions, as they are significantly cheaper than international transactions.

-

Compare Fees: Before sending money, compare the fees for different payment methods and choose the one with the lowest cost.

-

Use the Cash App Debit Card: If you have the Cash App debit card, you can link it to your account and use it to make purchases or withdraw cash, which can help you save on fees.

Additional Tips

Here are some additional tips to help you manage Cash App fees:

-

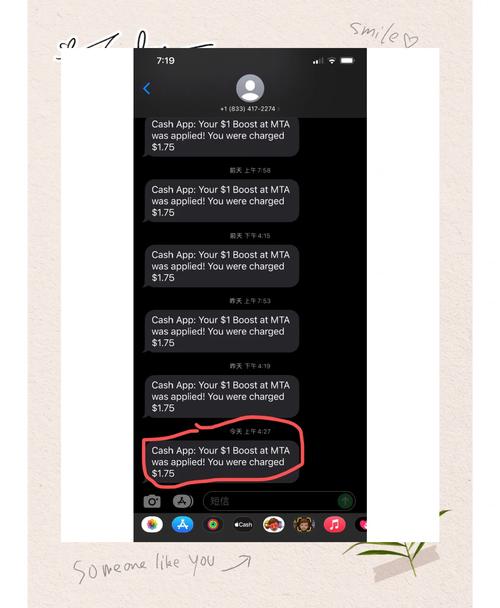

Keep Track of Your Transactions: Regularly review your transaction history to identify any unnecessary fees and adjust your spending habits accordingly.

-

Stay Informed: Keep up with any changes to Cash App’s fee structure to ensure you’re always aware of the latest rates.

-

Use the Cash App App: The Cash App app provides real-time updates on fees and transaction details, making it easier to manage your finances.

By understanding the Cash App fee structure and taking steps to minimize expenses, you can make the most of this convenient payment platform. Remember to stay informed and adjust your spending habits accordingly to keep your fees in check.