Understanding Cash App ATM Free Services

Cash App, a popular mobile payment service developed by Square, offers a range of features that make financial transactions convenient and accessible. One such feature that stands out is the Cash App ATM Free service. In this article, we will delve into the details of this service, its benefits, and how it compares to other banking options.

What is Cash App ATM Free?

Cash App ATM Free is a service that allows users to withdraw cash from ATMs without incurring any fees. This is particularly beneficial for those who rely on ATMs for cash withdrawals and want to avoid the additional costs associated with using other banking services.

How Does Cash App ATM Free Work?

When you use Cash App to withdraw cash from an ATM, the process is straightforward. Here’s a step-by-step guide:

- Open the Cash App on your smartphone.

- Tap on the “Cash” tab at the bottom of the screen.

- Select “ATM” from the options provided.

- Enter the amount you wish to withdraw.

- Choose the ATM location closest to you.

- Follow the on-screen instructions to complete the transaction.

Once you arrive at the ATM, you will need to enter your Cash App PIN and follow the prompts to withdraw the cash. It’s important to note that some ATMs may charge a surcharge for cash withdrawals, but Cash App covers this fee for eligible users.

Benefits of Cash App ATM Free

There are several advantages to using Cash App ATM Free:

- Cost-Effective: By covering the ATM surcharge, Cash App helps users save money on cash withdrawals.

- Convenience: The service allows users to access cash easily and quickly, without the need to visit a bank branch.

- Flexibility: Users can choose from a wide range of ATMs across the country, making it easy to find one that suits their needs.

- Security: Cash App uses advanced security measures to protect your financial information and ensure safe transactions.

How to Qualify for Cash App ATM Free

Not all Cash App users are eligible for the ATM Free service. Here are the criteria you need to meet:

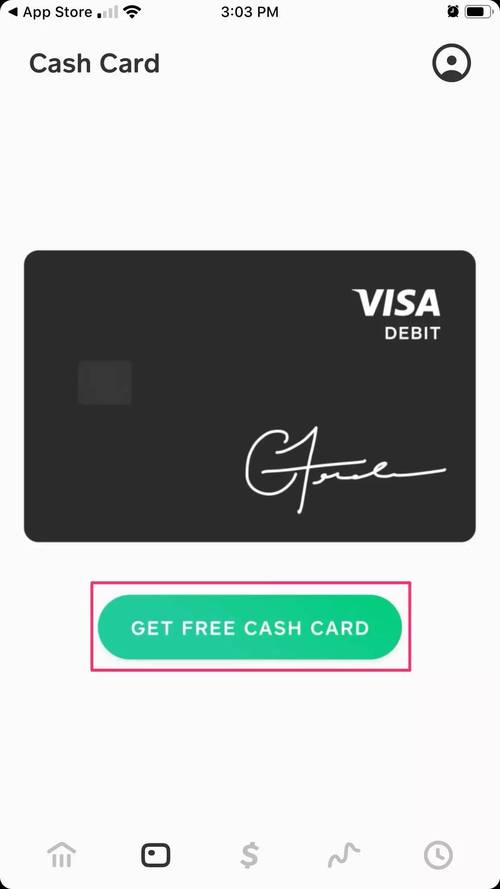

- Have a Cash App Checking Account: The ATM Free service is available only to users with a Cash App Checking Account.

- Be a Verified User: To ensure the security of your account, Cash App requires users to verify their identity.

- Have a Valid Debit Card: Your Cash App Checking Account must be linked to a valid debit card.

Once you meet these criteria, you can enjoy the benefits of Cash App ATM Free.

Comparing Cash App ATM Free to Other Banking Options

When it comes to cash withdrawals, Cash App ATM Free offers several advantages over traditional banking options:

| Feature | Cash App ATM Free | Traditional Banking |

|---|---|---|

| ATM Fees | No fees for eligible users | May charge ATM fees |

| Accessibility | Access to a wide range of ATMs | Limited to bank branches and ATMs |

| Security | Advanced security measures | Varies by bank |

| Convenience | Easy and quick access to cash | May require visiting a bank branch |

As you can see, Cash App ATM Free offers a more convenient and cost-effective solution for cash withdrawals compared to traditional banking options.

Conclusion

Cash App ATM Free is a valuable service that provides users with a convenient and cost-effective way to access cash. By covering ATM surcharges and offering a wide range of ATM locations, Cash App makes it easier for users to manage their