Cash App Account Money: A Comprehensive Guide

Managing your finances has never been easier, especially with the advent of mobile banking apps. One such app that has gained significant popularity is Cash App. In this detailed guide, we will delve into the various aspects of the Cash App account money, helping you understand how it works, its features, and how you can make the most out of it.

Understanding Cash App

Cash App is a mobile payment service developed by Square, Inc. It allows users to send and receive money, pay bills, and invest in stocks. The app is available for both iOS and Android devices and has over 36 million active users.

Creating a Cash App Account

Creating a Cash App account is a straightforward process. Here’s a step-by-step guide:

- Download the Cash App from the App Store or Google Play Store.

- Open the app and tap “Sign Up” or “Get $5 Free” (if you’re eligible for the referral program).

- Enter your phone number and verify it by entering the code sent to your phone.

- Set up a password and confirm your email address.

- Link your bank account or debit card to the app.

Once your account is set up, you can start using the app to manage your money.

Features of Cash App Account Money

Cash App offers a range of features that make it a versatile financial tool. Here are some of the key features:

1. Sending and Receiving Money

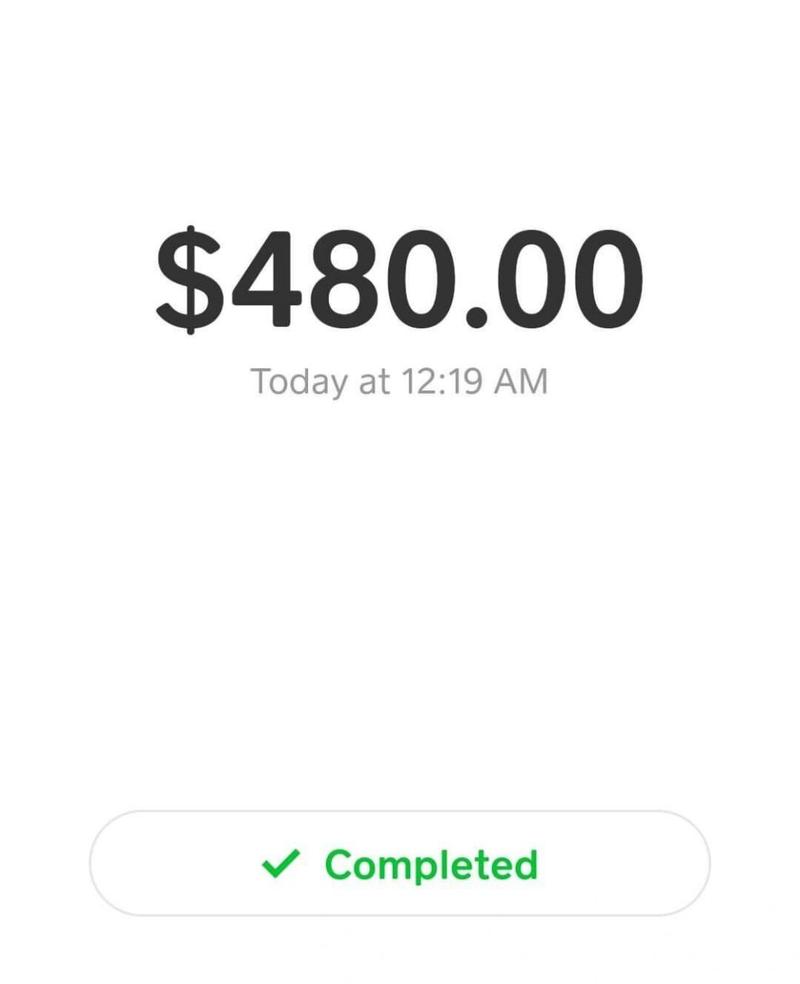

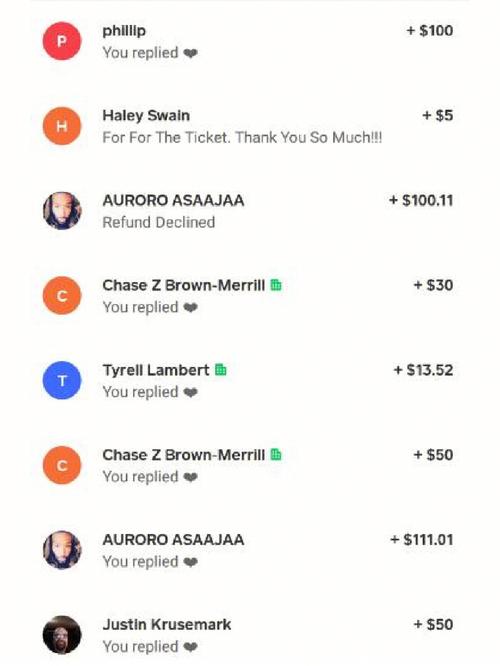

One of the primary functions of Cash App is to send and receive money. You can do this by entering the recipient’s $Cashtag or phone number. The transaction is usually instant, but it may take a few minutes depending on the recipient’s bank.

2. Paying Bills

Cash App allows you to pay your bills directly from the app. You can set up automatic payments for recurring bills, such as rent, utilities, and credit card payments.

3. Investing in Stocks

Cash App offers a unique feature that allows you to invest in stocks. You can start with as little as $1 and invest in a range of stocks, ETFs, and other assets. The app also provides real-time updates on your investments and allows you to buy fractional shares.

4. Cash Card

The Cash Card is a Visa debit card linked to your Cash App account. You can use it to make purchases online, in-store, or at ATMs. The card also comes with a $5 cashback bonus on direct deposits.

5. Direct Deposits

Cash App allows you to receive your paycheck, tax refunds, and other payments directly to your account. This feature is particularly useful for those who prefer to receive their earnings quickly.

6. Peer-to-Peer Payments

Peer-to-peer payments are a breeze with Cash App. You can easily send money to friends and family, split bills, and more.

Security and Privacy

Security and privacy are top priorities for Cash App. The app uses end-to-end encryption to protect your financial information. Additionally, you can set up a PIN or biometric authentication to access your account.

How to Make the Most Out of Cash App Account Money

Here are some tips to help you make the most out of your Cash App account:

- Link multiple bank accounts or debit cards to your Cash App for easy access to funds.

- Use the Cash Card for everyday purchases to earn cashback bonuses.

- Take advantage of the direct deposit feature to receive your earnings quickly.

- Invest in stocks to grow your money over time.

- Keep track of your spending and savings using the app’s financial tools.

Conclusion

Cash App is a powerful financial tool that can help you manage your money more efficiently. By understanding its features and using them effectively, you can take control of your finances and achieve your financial goals.

| Feature | Description |

|---|---|

| Send and Receive Money | Instantly send and receive money using the

|