Cash App 4.5 Interest: A Comprehensive Guide

Cash App, a popular mobile payment service, offers a variety of features to its users. One of the most intriguing aspects of Cash App is its interest rate on savings. In this article, we will delve into the details of Cash App’s 4.5% interest rate, exploring its benefits, eligibility criteria, and how it compares to other savings options. Let’s get started.

Understanding the 4.5% Interest Rate

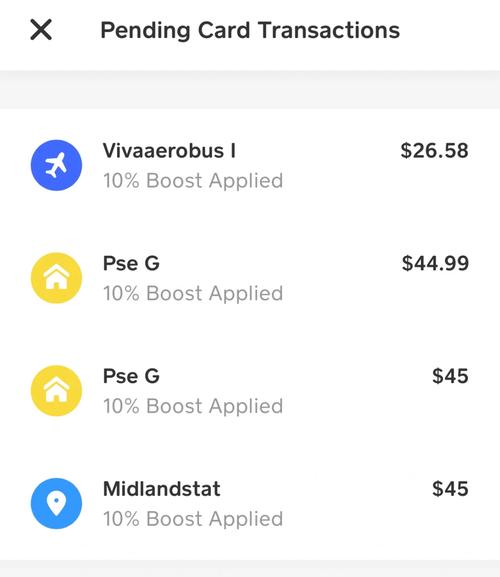

The 4.5% interest rate offered by Cash App is significantly higher than traditional savings accounts. This rate is variable and can change at any time, depending on the market conditions and Cash App’s policies. It’s important to note that this interest rate is only applicable to the Cash App’s “Cash” account, which is a checking account with a savings component.

Eligibility for the 4.5% Interest Rate

Not all Cash App users are eligible for the 4.5% interest rate. To qualify, you must meet the following criteria:

-

Have a Cash App account in good standing

-

Link a bank account to your Cash App account

-

Keep a minimum balance of $250 in your Cash account

It’s worth mentioning that the interest rate is only available for the first 12 months after you meet the eligibility criteria. After that, the rate may change, and you may no longer qualify for the 4.5% interest rate.

How to Qualify for the 4.5% Interest Rate

Qualifying for the 4.5% interest rate is relatively straightforward. Here’s a step-by-step guide to help you get started:

-

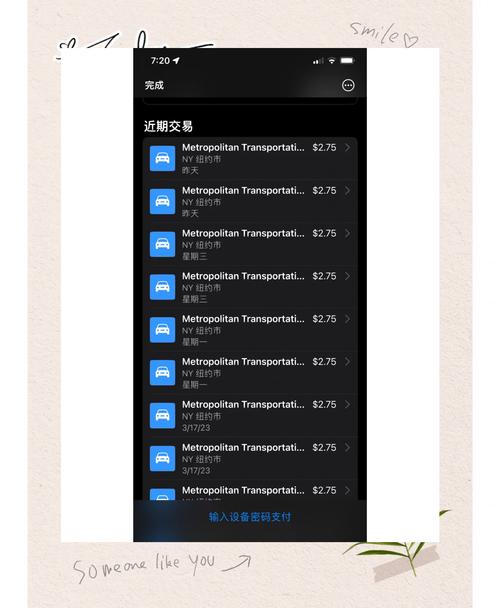

Download the Cash App from the App Store or Google Play Store

-

Sign up for a Cash App account and verify your identity

-

Link your bank account to your Cash App account

-

Keep a minimum balance of $250 in your Cash account for the first 12 months

By following these steps, you’ll be well on your way to earning the 4.5% interest rate on your savings.

Comparing Cash App’s 4.5% Interest Rate to Other Savings Options

When it comes to savings, there are numerous options available, each with its own set of benefits and drawbacks. Here’s a comparison of Cash App’s 4.5% interest rate to other popular savings options:

| Option | Interest Rate | Minimum Balance | Accessibility |

|---|---|---|---|

| Cash App 4.5% Interest Rate | 4.5% (variable) | $250 | Mobile app and website |

| Traditional Savings Account | 0.01% – 0.05% | $0 | Bank branches, ATMs, and online |

| High-Yield Savings Account | 1% – 2% | $0 – $1,000 | Online banks and mobile apps |

| Money Market Account | 1% – 2% | $1,000 – $10,000 | Online banks and mobile apps |

As you can see, Cash App’s 4.5% interest rate is significantly higher than traditional savings accounts and high-yield savings accounts. However, it’s important to consider the minimum balance requirement and the fact that the rate is variable.

Benefits of Using Cash App for Savings

There are several benefits to using Cash App for your savings needs:

-

Higher interest rates compared to traditional savings accounts

-

Easy access to your funds through the Cash App mobile