Cash App Interest: A Comprehensive Guide

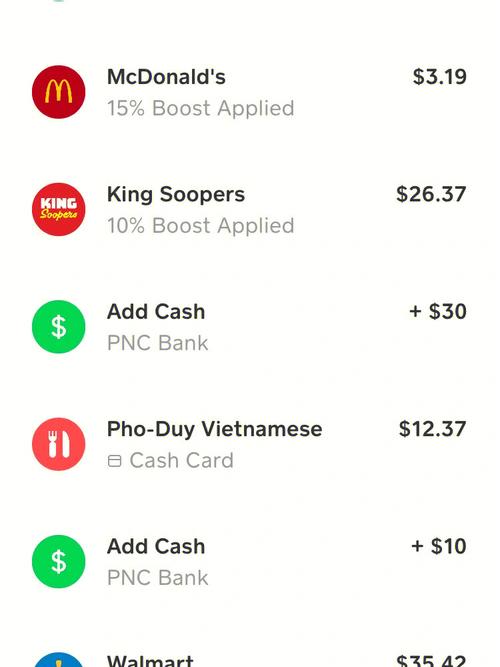

Cash App, a popular mobile payment service, offers a range of features to its users, including the Cash App Interest feature. This feature allows users to earn interest on their idle cash. In this article, we will delve into the details of Cash App Interest, exploring its benefits, requirements, and how it works. Let’s get started.

Understanding Cash App Interest

Cash App Interest is a feature that enables users to earn interest on the cash they have in their Cash App account. The interest rate is variable and can change at any time. It is important to note that the interest earned is subject to federal income tax.

How Does Cash App Interest Work?

When you sign up for Cash App Interest, you will be prompted to link your Cash App account to a bank account. This is necessary for the interest to be deposited into your bank account. Once your account is linked, Cash App will automatically calculate the interest earned on your idle cash and deposit it into your bank account on a monthly basis.

Here’s a step-by-step guide on how to earn interest with Cash App:

- Sign up for Cash App and link your bank account.

- Ensure that you have at least $1 in your Cash App account to start earning interest.

- Cash App will automatically calculate the interest earned on your idle cash.

- The interest will be deposited into your bank account on a monthly basis.

Benefits of Cash App Interest

Earning interest on your idle cash is a great way to boost your savings. Here are some of the benefits of using Cash App Interest:

- Passive Income: You can earn interest on your cash without having to do anything.

- Competitive Interest Rates: Cash App offers competitive interest rates compared to traditional savings accounts.

- Easy Access: You can access your funds at any time without any penalties.

- Security: Cash App uses advanced security measures to protect your account and funds.

Requirements for Cash App Interest

Before you can start earning interest with Cash App, you need to meet certain requirements:

- Age Requirement: You must be at least 18 years old to use Cash App Interest.

- Residency Requirement: You must be a resident of the United States.

- Account Verification: You must verify your Cash App account by providing your Social Security number and other personal information.

Interest Rates and Fees

The interest rate for Cash App Interest is variable and can change at any time. As of the latest information available, the interest rate is typically higher than that of traditional savings accounts. However, it is important to note that the interest rate may vary depending on the amount of cash in your account and other factors.

Here’s a table showing the current interest rates for Cash App Interest:

| Balance Range | Interest Rate |

|---|---|

| $1 – $50,000 | 1.75% – 2.75% |

| $50,001 – $100,000 | 1.75% – 2.75% |

| $100,001 – $250,000 | 1.75% – 2.75% |

| $250,001 – $500,000 | 1.75% – 2.75% |

| $500,001 – $1,000,000 | 1.75% – 2.75% |

There are no fees associated with Cash App Interest, making it a cost-effective way to earn interest on your idle cash.

Is Cash App Interest Right for You?

Whether Cash App Interest is right for you depends on your financial goals and needs. If you are looking for a way to earn interest on