Cash App Automatic Cash Out: A Comprehensive Guide

Are you a Cash App user looking to streamline your financial transactions? If so, you might have come across the “Automatic Cash Out” feature. This guide will delve into what it is, how it works, its benefits, and potential drawbacks. Let’s dive in.

What is Cash App Automatic Cash Out?

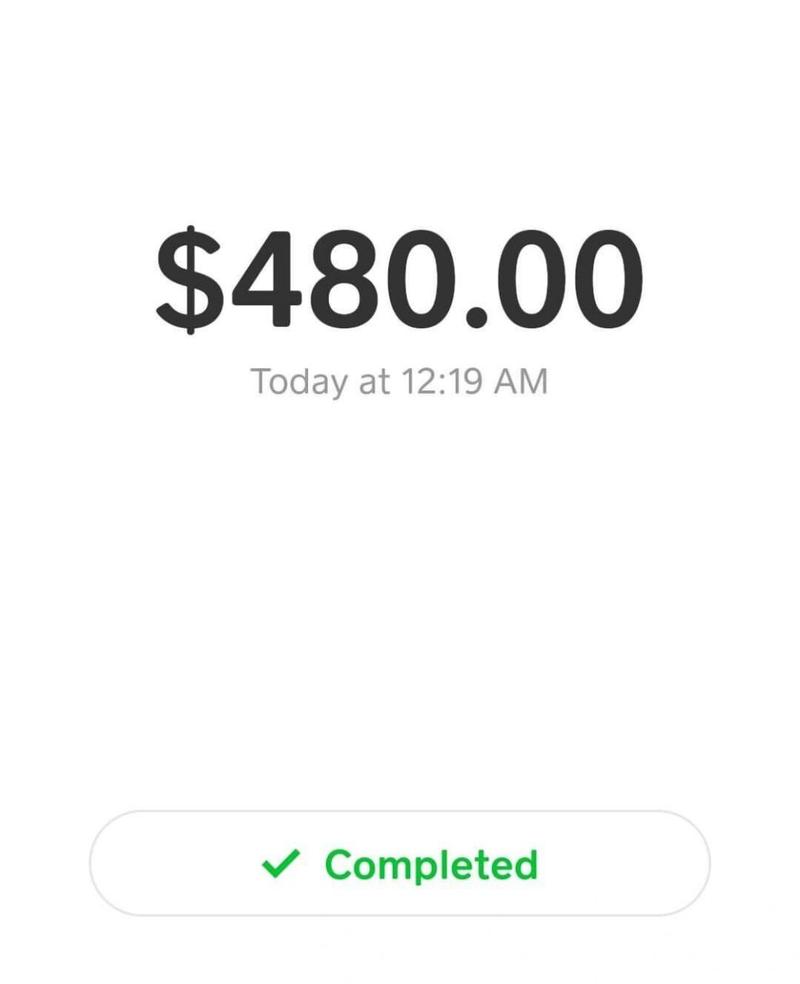

Cash App Automatic Cash Out is a feature that allows users to automatically transfer their Cash App balance to their linked bank account. This means that whenever your Cash App balance reaches a certain threshold, the app will automatically initiate the transfer to your bank account.

How Does It Work?

Here’s a step-by-step guide on how to set up and use the Automatic Cash Out feature:

- Open the Cash App on your smartphone.

- Tap on the “Bank” tab at the bottom of the screen.

- Scroll down and tap on “Automatic Cash Out.” If you haven’t set up Automatic Cash Out yet, you’ll be prompted to do so.

- Follow the on-screen instructions to link your bank account.

- Select the amount you want to transfer to your bank account each time your Cash App balance reaches the threshold.

- Set the threshold amount for Automatic Cash Out.

- Review and confirm the settings.

Once you’ve set up Automatic Cash Out, the app will automatically transfer your Cash App balance to your linked bank account whenever it reaches the threshold you’ve set.

Benefits of Automatic Cash Out

There are several benefits to using the Automatic Cash Out feature:

- Convenience: You don’t have to manually transfer your Cash App balance to your bank account, saving you time and effort.

- Security: Automatic Cash Out ensures that your Cash App balance is regularly transferred to your bank account, reducing the risk of losing money due to theft or fraud.

- Organization: Keeping your Cash App balance low can help you stay organized and avoid overspending.

Drawbacks of Automatic Cash Out

While Automatic Cash Out offers many benefits, there are also some potential drawbacks to consider:

- Transaction Fees: Cash App charges a small fee for each Automatic Cash Out transaction. While the fee is relatively low, it can add up over time.

- Lack of Control: Automatic Cash Out can be a double-edged sword. While it’s convenient, it can also lead to less control over your finances if you’re not careful.

How to Cancel Automatic Cash Out

If you decide that Automatic Cash Out isn’t for you, it’s easy to cancel the feature:

- Open the Cash App on your smartphone.

- Tap on the “Bank” tab at the bottom of the screen.

- Scroll down and tap on “Automatic Cash Out.” If you haven’t set up Automatic Cash Out yet, you’ll be prompted to do so.

- Tap on “Cancel Automatic Cash Out” and confirm the cancellation.

Table: Automatic Cash Out Fees

| Transaction Amount | Fee |

|---|---|

| $1 – $50 | $1.00 |

| $51 – $100 | $1.50 |

| $101 – $250 | $2.00 |

| $251 – $500 | $2.50 |

| $501 – $1,000 | $3.00 |

| $1,001 – $2,500 | $3.50 |

| $2,501 – $5,000 | $4.00 |