Understanding Cash App: A Comprehensive Guide

Cash App, a product of Square, Inc., has become a popular choice for financial transactions among individuals and businesses alike. With its user-friendly interface and a range of features, it’s no wonder why it’s often compared to the likes of Alipay and WeChat Pay in China. If you’re new to Cash App or simply looking to dive deeper into its offerings, here’s a detailed look at what Cash App has to offer.

Getting Started with Cash App

Before you can start using Cash App, you’ll need to download the app from the App Store or Google Play Store. Once installed, you’ll be prompted to create an account. This involves providing your basic information, including your name, email address, and phone number. You’ll also need to link a bank account or a debit card to your Cash App account for transactions.

Key Features of Cash App

Cash App offers a variety of features that cater to different financial needs:

| Feature | Description |

|---|---|

| Peer-to-Peer Transfers | Send and receive money from friends, family, or colleagues using their phone number, email address, or Cash App username. |

| Cash Card | Get a Cash Card, a Visa debit card that you can use to make purchases online or in-store, withdraw cash from ATMs, and get cash back at participating retailers. |

| Direct Deposits | Receive your paycheck, tax refunds, and other payments directly into your Cash App account. |

| Investing | Buy and sell stocks, ETFs, and Bitcoin directly within the app. |

| Cash Boost | Get discounts on purchases at participating retailers when you pay with your Cash Card. |

| Tax Services | Prepare and file your taxes for free using the Cash App tax service. |

Using Cash App for Peer-to-Peer Transfers

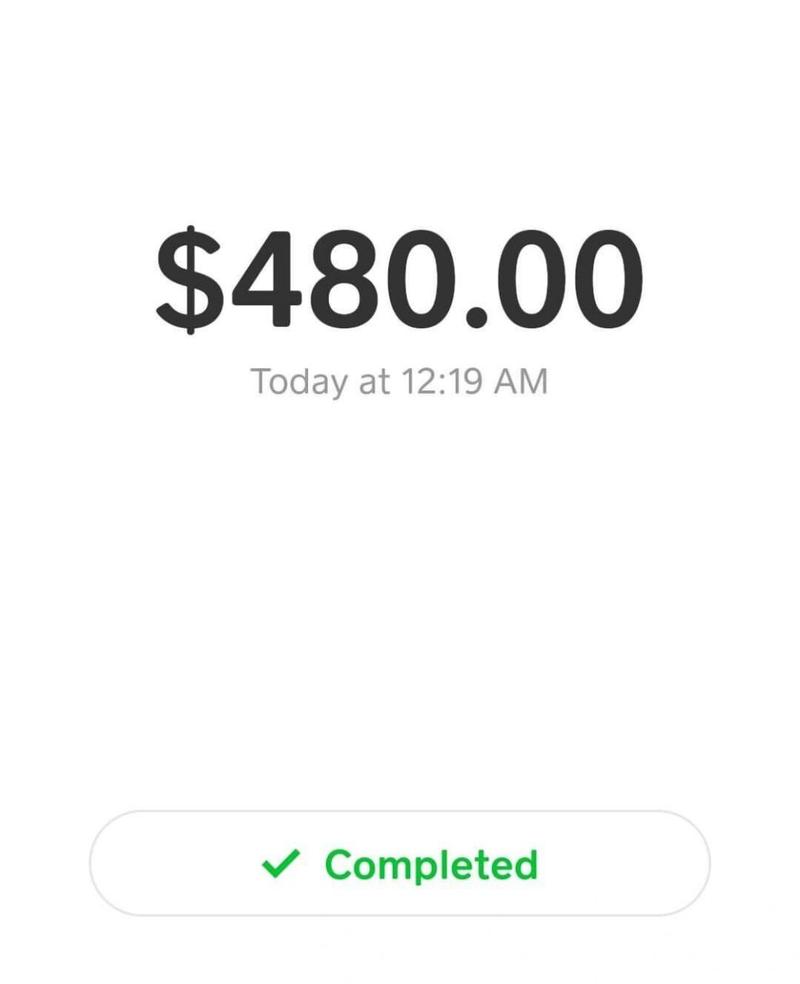

One of the most popular features of Cash App is its peer-to-peer transfer capabilities. To send money, simply enter the recipient’s phone number, email address, or Cash App username. You can also set up recurring payments for regular expenses like rent or bills. To receive money, provide your Cash App username to the person sending you the funds.

Understanding the Cash Card

The Cash Card is a Visa debit card that you can use to make purchases online or in-store, withdraw cash from ATMs, and get cash back at participating retailers. You can customize the look of your Cash Card and even choose a unique design. The Cash Card is linked to your Cash App account, so any funds you have in your account can be used to make purchases.

Investing with Cash App

Cash App allows you to invest in stocks, ETFs, and Bitcoin directly within the app. This feature is particularly appealing to beginners who want to start investing with small amounts of money. You can set up automatic investments, known as “Roundups,” which round up your purchases to the nearest dollar and invest the difference in your chosen investments.

Using Cash Boost for Discounts

Cash Boost is a feature that offers discounts on purchases at participating retailers when you pay with your Cash Card. To find deals, simply check the Cash Boost section in the app. This feature can help you save money on everyday purchases.

Preparing and Filing Taxes with Cash App

Cash App offers a free tax service that allows you to prepare and file your taxes. This service is available to all Cash App users and can help you save money on tax preparation fees.

Conclusion

Cash App is a versatile financial tool that offers a range of features to help you manage your money. Whether you’re looking to send and receive money, invest, or simply save money on everyday purchases, Cash App has something to offer. With its user-friendly interface and convenient features, it’s no wonder why Cash App has become a popular choice for many.