Understanding the Cash App Card

The Cash App card, also known as the Cash Card, is a versatile and convenient financial tool offered by Square, the company behind the popular Cash App. This card is designed to simplify your financial transactions, whether you’re sending money to friends, making purchases online, or managing your daily expenses. Let’s dive into a detailed review of the Cash App card, exploring its features, benefits, and how it compares to other financial products.

Key Features of the Cash App Card

Here are some of the standout features of the Cash App card:

| Feature | Description |

|---|---|

| Point-of-Sale (POS) Transactions | Use your Cash Card at any merchant that accepts Visa, making it a convenient option for everyday purchases. |

| Online Purchases | Shop online with ease, as the Cash Card is accepted by most e-commerce platforms. |

| Direct Deposits | Receive your paychecks, government benefits, or other direct deposits directly to your Cash App account. |

| Peer-to-Peer Transfers | Send and receive money from friends and family using the Cash App, with real-time transfers available. |

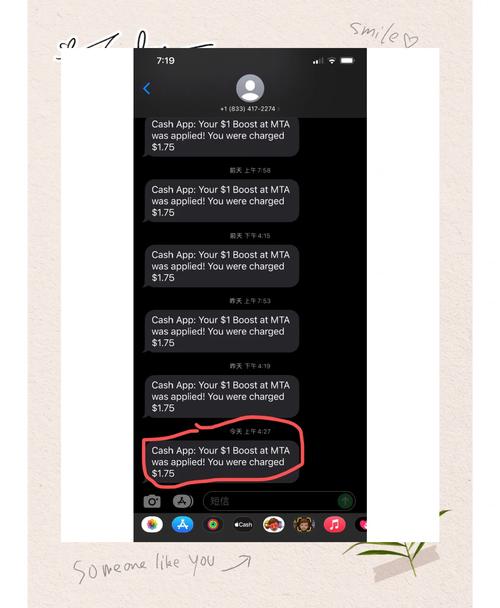

| Cash Boost Offers | Enjoy discounts and cashback offers at participating merchants, making your purchases more rewarding. |

Benefits of the Cash App Card

Here are some of the benefits of using the Cash App card:

- Convenience: The Cash Card is a single card that can be used for various financial transactions, making it easier to manage your finances.

- Security: The Cash Card comes with advanced security features, including fraud protection and the ability to lock and unlock the card remotely.

- Customization: You can customize the look of your Cash Card, choosing from various designs and even adding your name or a personal message.

- Financial Management Tools: The Cash App provides tools to help you track your spending, set budgets, and manage your finances more effectively.

How to Get a Cash App Card

Obtaining a Cash App card is a straightforward process:

- Download the Cash App on your smartphone.

- Sign up for an account and link a bank account or credit/debit card.

- Apply for a Cash Card within the app.

- Wait for your card to arrive in the mail.

- Activate your Cash Card using the instructions provided in the app.

Comparing the Cash App Card to Other Financial Products

When comparing the Cash App card to other financial products, such as traditional bank debit cards or credit cards, there are a few key differences to consider:

- Interest Rates: The Cash App card does not charge interest on purchases, making it a great option for those who want to avoid paying interest.

- Annual Fees: The Cash App card does not have an annual fee, unlike some traditional bank cards.

- Rewards Programs: While the Cash App card does not offer a rewards program like some credit cards, it does provide Cash Boost offers that can save you money on purchases.

Conclusion

The Cash App card is a versatile and convenient financial tool that can help you manage your daily expenses, send money to friends and family, and even invest in stocks and cryptocurrencies through the Cash App. With its user-friendly interface, advanced security features, and customization options, the Cash App card is a great choice for those looking for a simple and efficient way to manage their finances.