Cash App History: A Detailed Overview

Cash App, a popular mobile payment service, has transformed the way people send and receive money. Launched in 2013, it has grown to become a significant player in the fintech industry. If you’re curious about the history of Cash App and how it has evolved over the years, you’ve come to the right place. Let’s dive into the fascinating journey of Cash App.

Origins and Founders

Cash App was founded by Jack Dorsey, the co-founder of Twitter, and his business partner, Nathan Gettings. The idea for Cash App originated from their desire to create a simple and secure way for people to send and receive money. In 2013, they launched the app, which was initially called Square Cash.

Early Years and Growth

During its early years, Cash App focused on providing a user-friendly interface and a straightforward process for sending and receiving money. The app quickly gained popularity among friends and family members who wanted an easy way to split bills or pay each other back. In 2015, Square, the parent company of Cash App, acquired the app, which allowed it to expand its user base and features.

One of the key features that set Cash App apart from its competitors was its integration with Bitcoin. In 2014, Cash App introduced Bitcoin trading, making it one of the first mobile payment apps to offer this service. This move helped Cash App attract tech-savvy users and investors who were interested in cryptocurrencies.

Expanding Services

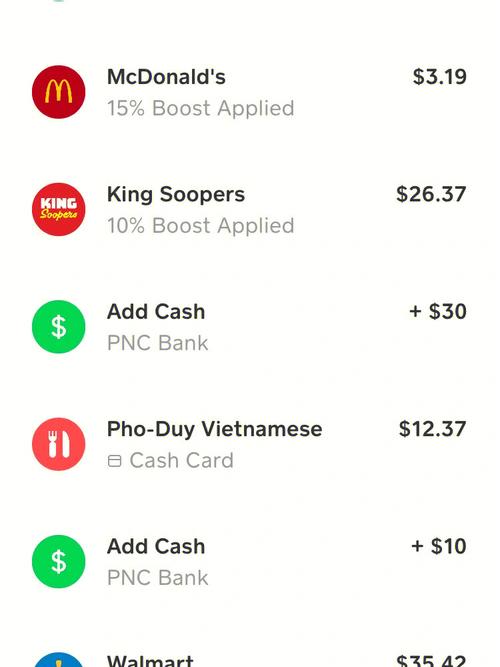

Over the years, Cash App has expanded its services to include more than just peer-to-peer money transfers. In 2016, the app introduced a cash card, allowing users to spend their Cash App balance at any location that accepts Visa. This feature made Cash App a more versatile payment option for users.

In 2018, Cash App launched its stock trading feature, allowing users to buy and sell shares of popular companies like Apple, Amazon, and Google. This move further solidified Cash App’s position as a financial services platform, not just a payment app.

User Experience and Security

Cash App has always prioritized user experience and security. The app’s interface is intuitive, making it easy for users to navigate and perform transactions. Additionally, Cash App uses advanced encryption and security measures to protect users’ financial information.

One of the unique features of Cash App is its use of a $Cashtag, which allows users to share their Cash App account information with others. This feature makes it easier for users to receive money from friends, family, or businesses.

Controversies and Legal Issues

Like any successful company, Cash App has faced its fair share of controversies and legal issues. One of the most notable controversies was the app’s handling of Bitcoin transactions. In 2018, Cash App faced criticism for its slow processing times and high fees for Bitcoin transactions. The company has since made improvements to its Bitcoin service.

Another legal issue Cash App has faced is related to its stock trading feature. In 2019, the company was sued by a user who claimed that Cash App’s stock trading platform was misleading and caused him financial losses. The lawsuit was later settled out of court.

Future Prospects

As the fintech industry continues to grow, Cash App is well-positioned to expand its services and reach. The company has already made significant strides in mobile payments, stock trading, and Bitcoin trading. With its user-friendly interface and focus on security, Cash App is likely to remain a popular choice for users looking for a comprehensive financial services platform.

One potential area for growth is in international transactions. Cash App has already started to expand its services to other countries, and it could continue to do so in the future. This would allow users to send and receive money across borders, making Cash App an even more valuable tool for global financial transactions.

In conclusion, Cash App has come a long way since its inception in 2013. From a simple peer-to-peer money transfer app to a comprehensive financial services platform, Cash App has proven to be a versatile and innovative player in the fintech industry. As the company continues to evolve and expand its services, it will be interesting to see how it shapes the future of mobile payments and financial services.