Cash App Money: A Comprehensive Guide

Cash App Money is a versatile financial service offered by Square, Inc., designed to make managing your finances easier and more convenient. Whether you’re looking to send money to friends, pay bills, or invest in stocks, Cash App Money has got you covered. In this detailed guide, we’ll explore the various features, benefits, and limitations of Cash App Money, so you can make an informed decision about whether it’s the right financial tool for you.

How to Get Started with Cash App Money

Before diving into the features, let’s go over how to get started with Cash App Money. To sign up, download the Cash App from the App Store or Google Play Store, create an account, and link your bank account or credit/debit card. Once your account is verified, you’re ready to start using the app.

Transferring Money

One of the primary uses of Cash App Money is transferring money. You can send and receive money from friends, family, or anyone with a Cash App account. Here’s how it works:

- Open the Cash App and tap the dollar sign icon to access the “Pay” or “Request” feature.

- Enter the recipient’s $Cashtag or phone number.

- Enter the amount you want to send or request.

- Confirm the transaction.

Transfers between Cash App users are typically instant, but it may take a few minutes for the money to appear in the recipient’s account, depending on their bank’s processing time.

Paying Bills

Cash App Money allows you to pay bills directly from the app. To pay a bill:

- Tap the “Bills” tab at the bottom of the screen.

- Select the bill you want to pay.

- Enter the amount and payment date.

- Confirm the payment.

Cash App Money supports various types of bills, including utilities, phone, internet, and more. You can even set up recurring payments for regular bills.

Investing in Stocks

In addition to sending money and paying bills, Cash App Money allows you to invest in stocks. Here’s how it works:

- Tap the “Invest” tab at the bottom of the screen.

- Choose the amount you want to invest.

- Select the stock you want to buy.

- Confirm the transaction.

Cash App Money offers a range of popular stocks, including Apple, Amazon, and Google. You can also set up automatic investments to buy stocks at regular intervals.

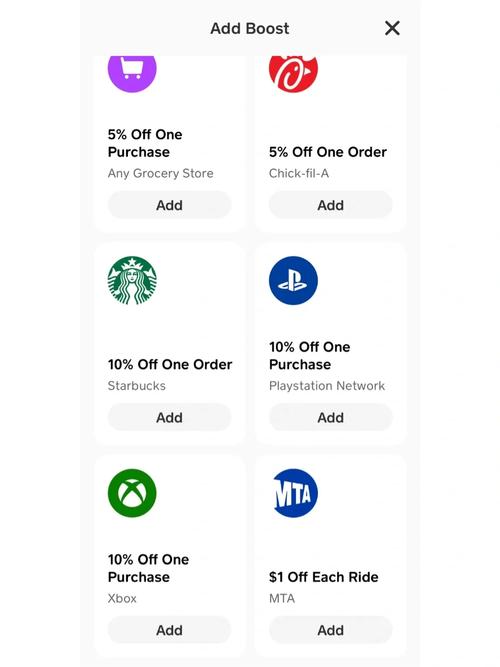

Using the Cash Card

The Cash Card is a Visa debit card linked to your Cash App account. You can use it to make purchases online, in-store, or at ATMs. Here’s how to get started:

- Tap the “Cash Card” tab at the bottom of the screen.

- Follow the instructions to activate your Cash Card.

- Use your Cash Card to make purchases.

The Cash Card also comes with a cash-back feature, allowing you to earn money back on certain purchases.

Security and Privacy

Security and privacy are top priorities for Cash App Money. The app uses end-to-end encryption to protect your financial information, and you can set up two-factor authentication for an extra layer of security. Additionally, Cash App Money is a registered money transmitter, meaning it complies with all relevant financial regulations.

Customer Support

Cash App Money offers customer support through email, phone, and chat. You can contact support for help with account issues, transactions, or any other questions you may have.

Pros and Cons

Like any financial service, Cash App Money has its pros and cons:

| Pros | Cons |

|---|---|

| Easy to use | Transaction fees may apply |

| Wide range of features | Not available in all countries |

| Instant transfers |