Understanding Cash App Numbers

Cash App, developed by Square, has become a popular financial service platform that offers a variety of features to its users. In this article, we will delve into the different aspects of Cash App, including its user base, financial transactions, and market position.

User Base and Market Position

As of 2022, Cash App boasts over 50 million active users, making it one of the most popular financial services platforms in the United States. According to a Pew Research Center study, Cash App is used by 26% of American adults, ranking it behind PayPal (57%) and Venmo (38%) but ahead of Zelle (36%). This impressive user base is a testament to the platform’s popularity and reliability.

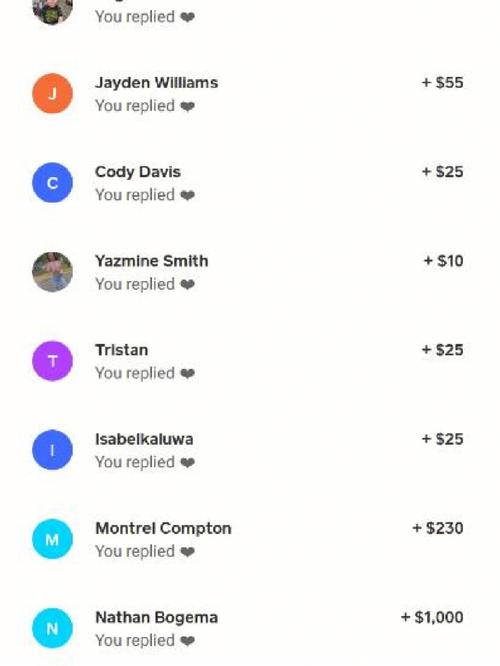

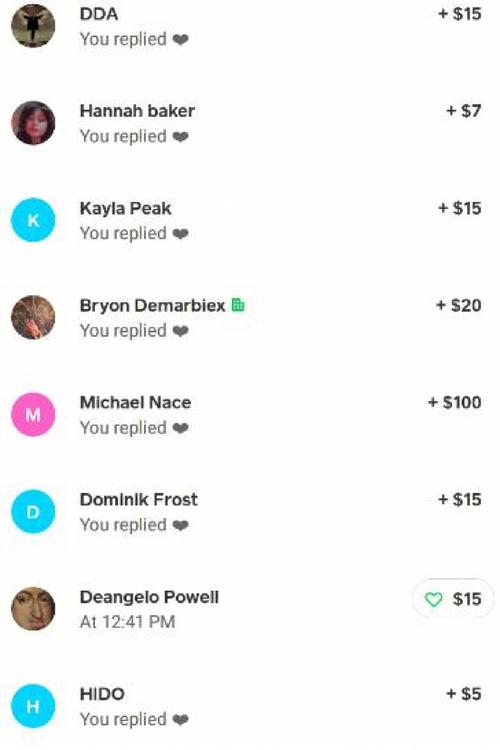

Financial Transactions

Cash App offers a range of financial services, including peer-to-peer (P2P) transfers, direct deposits, and Cash Card transactions. Here’s a breakdown of the key financial transactions on Cash App:

| Transaction Type | Description |

|---|---|

| P2P Transfers | Users can send and receive money from friends and family using their phone numbers, email addresses, or Cashtags. |

| Direct Deposits | Cash App allows users to receive their paychecks directly into their Cash App account, making it easier to manage their finances. |

| Cash Card Transactions | The Cash Card is a Visa debit card that can be used to make purchases online or in-store, as well as withdraw cash from ATMs. |

Additional Features

In addition to its core financial services, Cash App offers several other features that enhance the user experience:

-

Cash Boost: Users can earn cashback on purchases made with their Cash Card.

-

Stock and Bitcoin Trading: Cash App allows users to buy and sell stocks and Bitcoin directly within the app.

-

Debit Card Customization: Users can customize their Cash Card with a unique design.

-

Free Tax Filing: Cash App offers free tax filing services to users.

Comparison with Other Financial Services

When comparing Cash App with other financial services, it’s important to consider its unique features and user base. Here’s a brief comparison with some of its main competitors:

| Financial Service | Description |

|---|---|

| PayPal | PayPal is a widely used online payment system that allows users to send and receive money, make purchases, and withdraw cash from ATMs. |

| Venmo | Venmo is a mobile payment service that allows users to send and receive money from friends and family, as well as make purchases online and in-store. |

| Cash App | Cash App offers a range of financial services, including P2P transfers, direct deposits, Cash Card transactions, and stock and Bitcoin trading. |

Conclusion

Cash App has become a go-to financial service platform for millions of users due to its wide range of features, ease of use, and competitive pricing. Whether you’re looking to send money to a friend, receive your paycheck, or invest in stocks and Bitcoin, Cash App has you covered.