Cash App Online: A Comprehensive Guide for Users

Cash App Online has become a popular choice for individuals and businesses alike, offering a convenient and secure way to manage finances. Whether you’re looking to send money, receive payments, or invest, Cash App has got you covered. In this detailed guide, we’ll explore the various features, benefits, and limitations of Cash App Online, ensuring you have all the information you need to make informed decisions.

How to Get Started with Cash App Online

Before diving into the features and benefits of Cash App Online, it’s important to know how to get started. Here’s a step-by-step guide to help you create an account and begin using the app:

- Download the Cash App from the App Store or Google Play Store.

- Open the app and tap “Sign Up” or “Create Account”.

- Enter your phone number and verify it by entering the code sent to your phone.

- Set up a password and confirm your email address.

- Link your bank account or credit/debit card to the app.

Once you’ve completed these steps, you’ll be ready to start using Cash App Online.

Key Features of Cash App Online

Cash App Online offers a range of features that cater to different financial needs. Here are some of the most notable features:

1. Sending and Receiving Money

Cash App allows you to send and receive money quickly and easily. Simply enter the recipient’s $Cashtag or phone number, enter the amount, and tap “Pay” or “Request”. The transaction is typically processed instantly, although it may take a few minutes for the funds to be available in the recipient’s account.

2. Bank Account and Card Linking

Linking your bank account or credit/debit card to Cash App Online allows you to make purchases, withdraw cash, and transfer funds between accounts. You can also set up direct deposit for your paycheck, ensuring you have access to your funds as soon as possible.

3. Investing

Cash App offers a unique investment feature called “Cash Invest”, which allows you to invest in a portfolio of stocks and ETFs. You can choose from various investment options, and the app provides real-time updates on your portfolio’s performance.

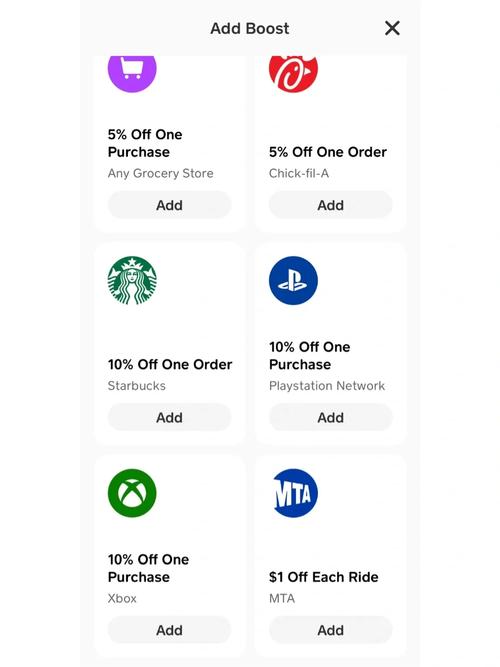

4. Cash Card

The Cash Card is a Visa debit card that’s linked to your Cash App account. You can use the card to make purchases online, in-store, or at ATMs. The Cash Card also comes with a $5 bonus when you spend $250 in your first 30 days.

5. Bill Pay

Cash App allows you to pay your bills directly from the app. Simply enter the biller’s information, choose the amount, and set up a payment date. You can also receive notifications when your bills are due, ensuring you never miss a payment.

Benefits of Using Cash App Online

There are several benefits to using Cash App Online, including:

- Convenience: Cash App is available on both iOS and Android devices, making it easy to manage your finances on the go.

- Security: Cash App uses advanced encryption and security measures to protect your personal and financial information.

- Low Fees: Cash App charges minimal fees for transactions, with no monthly subscription fees.

- Investment Opportunities: The Cash Invest feature allows you to grow your money by investing in the stock market.

Limitations of Cash App Online

While Cash App Online offers many benefits, there are also some limitations to consider:

- Availability: Cash App is only available in the United States.

- Transaction Limits: There are daily and weekly limits on the amount you can send, receive, and spend using Cash App.

- No Physical Branches: Cash App does not have physical branches, which may be a drawback for some users.

How to Get the Most Out of Cash App Online

Here are some tips to help you make the most of your Cash App Online experience:

- Keep your account information up to date.

- Use the Cash Card for everyday purchases.

- Take advantage of the Cash Invest feature to grow your money.

- Stay informed about your