Cash App Money Transfer: A Comprehensive Guide

Cash App is a popular mobile payment service that allows users to send and receive money quickly and easily. One of its key features is the money transfer service, which is widely used by individuals and businesses alike. In this article, we will delve into the various aspects of Cash App money transfer, including its benefits, how to use it, fees, and security measures.

How Does Cash App Money Transfer Work?

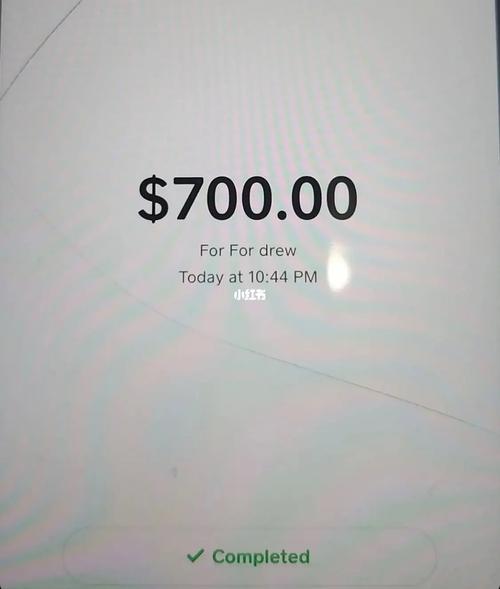

Cash App money transfer is a straightforward process. To send money, you need to have the recipient’s phone number or email address. Once you have this information, you can initiate a transfer from your Cash App account. The money is typically deposited into the recipient’s Cash App account within minutes, depending on the time of day and the recipient’s bank account status.

Here’s a step-by-step guide on how to send money using Cash App money transfer:

- Open the Cash App on your smartphone.

- Tap on the “Pay” button.

- Enter the recipient’s phone number or email address.

- Enter the amount you wish to send.

- Review the transaction details and tap “Send” to complete the transfer.

Benefits of Using Cash App Money Transfer

There are several benefits to using Cash App money transfer:

- Speed: Money transfers are typically processed within minutes, making it a convenient option for urgent transactions.

- Security: Cash App uses advanced encryption and security measures to protect your financial information.

- Accessibility: The service is available to users in the United States and can be accessed through the Cash App mobile app.

- Low Fees: Cash App offers free money transfers between users with Cash App accounts. However, there may be fees for sending money to a bank account or using a credit or debit card.

Understanding Cash App Money Transfer Fees

While Cash App offers free money transfers between users with Cash App accounts, there are fees associated with other types of transfers:

| Transfer Type | Fee |

|---|---|

| Bank Account Transfer | $1.00 |

| Credit or Debit Card Transfer | 3.5% of the transfer amount |

It’s important to note that these fees are subject to change, and Cash App may offer promotions or discounts on certain types of transfers.

Security Measures in Cash App Money Transfer

Security is a top priority for Cash App, and the company has implemented several measures to protect your financial information:

- Encryption: Cash App uses end-to-end encryption to secure your data during transmission.

- Two-Factor Authentication: You can enable two-factor authentication to add an extra layer of security to your account.

- Account Locking: If you suspect unauthorized activity on your account, you can lock it immediately to prevent further access.

Customer Support and Troubleshooting

In case you encounter any issues with Cash App money transfer, you can reach out to customer support for assistance. Cash App offers several support options, including:

- Email: You can send an email to support@cashapp.com.

- Phone: You can call customer support at 1-833-759-8273.

- Chat: You can chat with a customer support representative through the Cash App mobile app.

Before contacting customer support, it’s a good idea to check the Cash App help center for answers to common questions and troubleshooting tips.

Conclusion

Cash App money transfer is a convenient and secure way to send and receive money. With its low fees, fast processing times, and robust security measures, it’s no wonder that Cash App has become a popular choice for many users. Whether you’re sending money to a friend or paying a bill, Cash