Understanding Cash App: A Detailed Guide

Cash App, a product of Square, Inc., has become a popular choice for financial transactions among individuals and businesses alike. If you’re considering using Cash App, here’s a comprehensive guide to help you understand its features, benefits, and how it works.

What is Cash App?

Cash App is a mobile payment service that allows users to send and receive money, invest in stocks and cryptocurrencies, and even apply for a Cash Card. It’s a versatile app that has grown from a simple peer-to-peer payment service to a comprehensive financial platform.

Key Features of Cash App

Here’s a breakdown of the main features that Cash App offers:

| Feature | Description |

|---|---|

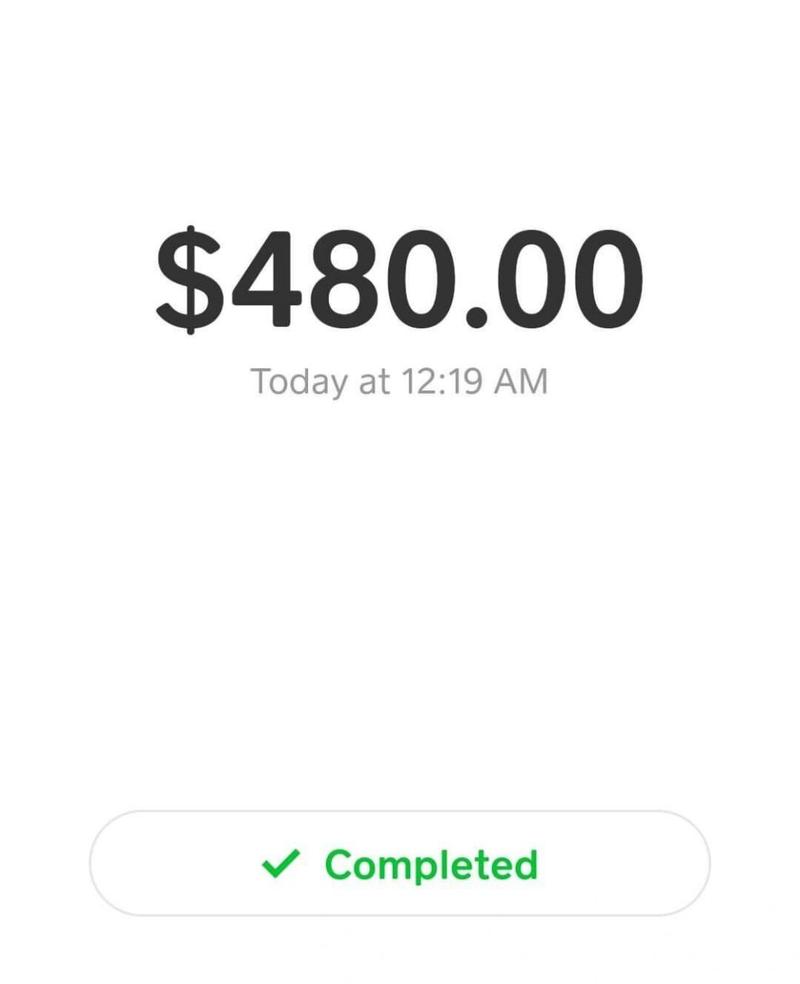

| Peer-to-Peer Transfers | Send and receive money from friends, family, or colleagues using their phone number, email, or Cashtag. |

| Cash Card | Get a Cash Card that can be used to make purchases, withdraw cash from ATMs, and even get cash back at certain retailers. |

| Stocks and Cryptocurrency | Invest in stocks and cryptocurrencies directly from the app. |

| Direct Deposit | Receive your paycheck, government benefits, or other payments directly into your Cash App account. |

| Cash Boost | Get discounts on purchases at various retailers by using your Cash Card. |

How to Use Cash App

Using Cash App is straightforward. Here’s a step-by-step guide to help you get started:

- Download the Cash App from the App Store or Google Play Store.

- Open the app and sign up for an account.

- Link your bank account or credit/debit card to the app.

- Start sending and receiving money, investing in stocks and cryptocurrencies, and using your Cash Card.

Benefits of Using Cash App

There are several benefits to using Cash App:

- Convenience: Send and receive money quickly and easily from anywhere.

- Security: Your account is protected by a PIN and two-factor authentication.

- Investment Opportunities: Invest in stocks and cryptocurrencies directly from the app.

- Discounts: Get discounts on purchases at various retailers through Cash Boost.

Is Cash App Safe to Use?

Cash App is a secure platform, but like any financial service, it’s important to take precautions:

- Use a Strong Password: Create a strong, unique password for your Cash App account.

- Keep Your Account Information Private: Do not share your account information with anyone.

- Monitor Your Account: Regularly check your account for any suspicious activity.

Alternatives to Cash App

While Cash App is a popular choice, there are other mobile payment services available, such as:

- PayPal: A widely used payment service that offers a variety of features, including peer-to-peer transfers, online shopping, and invoicing.

- Venmo: A popular peer-to-peer payment service that’s particularly well-suited for social payments.

- Apple Pay: A mobile payment service that allows you to make purchases using your iPhone, iPad, or Apple Watch.

Conclusion

Cash App is a versatile financial platform that offers a range of features to meet your needs. Whether you’re looking for a simple way to send and receive money or want to invest in stocks and cryptocurrencies, Cash App has you covered. Just remember to take precautions to keep your account secure.