Understanding the Basics of CashApps

CashApps is a popular mobile payment service that has gained significant traction in recent years. It allows users to send, receive, and store money securely. Whether you’re a small business owner or an individual looking for a convenient way to manage your finances, CashApps offers a range of features that cater to your needs.

How to Get Started with CashApps

Getting started with CashApps is a straightforward process. Here’s a step-by-step guide to help you set up your account:

- Download the CashApps app from your device’s app store.

- Open the app and tap on “Sign Up” or “Create Account”.

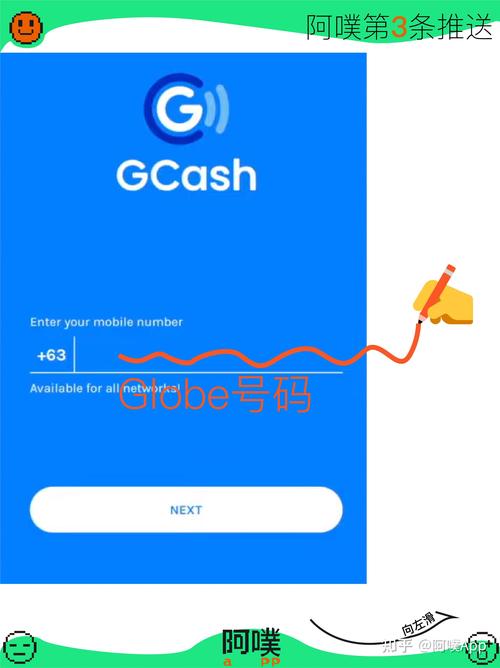

- Enter your phone number and verify it by entering the code sent to your phone.

- Set up a password and choose a username.

- Link your bank account or credit/debit card to the app for easy money transfers.

Key Features of CashApps

CashApps offers a variety of features that make it a versatile payment solution:

- Peer-to-Peer Transfers: Send and receive money from friends, family, or colleagues quickly and easily.

- Business Tools: Accept payments from customers, track expenses, and manage your business finances all in one place.

- Direct Deposit: Have your salary, tax refunds, or other payments deposited directly into your CashApps account.

- Debit Card: Use the CashApps debit card to make purchases, withdraw cash from ATMs, and get cash back at participating retailers.

- Bill Pay: Pay your bills directly from the app, saving time and reducing paper clutter.

Security and Privacy

Security is a top priority for CashApps. Here are some of the measures they take to protect your information:

- End-to-End Encryption: All data transmitted between your device and CashApps’ servers is encrypted to prevent unauthorized access.

- Two-Factor Authentication: Add an extra layer of security by enabling two-factor authentication on your account.

- Account Monitoring: CashApps continuously monitors your account for suspicious activity and alerts you if any issues are detected.

Using CashApps for Business

CashApps offers a range of features that make it an excellent choice for small businesses:

- Accepting Payments: Accept payments from customers using their CashApps account, credit/debit card, or Apple Pay.

- Customizable Invoices: Create and send professional invoices directly from the app.

- Expense Tracking: Keep track of your business expenses and categorize them for easy reporting.

- Integration with QuickBooks: Sync your CashApps account with QuickBooks for seamless financial management.

Comparing CashApps with Other Payment Solutions

When choosing a payment solution, it’s important to compare the features and fees of different options. Here’s a quick comparison of CashApps with some of its competitors:

| Payment Solution | Peer-to-Peer Transfers | Business Tools | Direct Deposit | Debit Card |

|---|---|---|---|---|

| CashApps | Yes | Yes | Yes | Yes |

| PayPal | Yes | Yes | Yes | Yes |

| Stripe | No | Yes | No | No |

| Payoneer | No | Yes | Yes |